Category: Refinancing

In today’s economic climate, many homeowners may find it challenging to make their large monthly mortgage payments. Especially for first-time homeowners, an unwieldy mortgage payment may feel stressful and overwhelming. This is a common factor that drives many homeowners to seek refinancing. Because refinancing often results in a lower interest rate, some homeowners may also seek a new mortgage for that reason. In either case, the objective is nearly always to save money and/or ensure that your mortgage remains financially feasible for you.

Keeping this in mind, it’s important that you, the homeowner, watch out for closing costs when refinancing your mortgage.

What Are Mortgage Refinancing Closing Costs?

The prospect of refinancing a mortgage can seem daunting, not least in part due to fear about expensive closing costs. There really is no way to completely avoid closing costs during a mortgage refinance, however, there are some common ways to avoid paying them upfront. Typically, during a “no-closing-costs” refinance, the closing costs are simply folded into your principal payment. Sometimes a lender will recoup their closing costs by increasing the interest rate. In either scenario, know that you, the homeowner, will likely not be able to completely avoid paying closing costs — but you may be able to avoid paying them all upfront.

There are several components of the mortgage refinancing process that require fees and payments, just as there were at the time that you first purchased your home. When added together, these fees and payments make up what are collectively considered the closing costs.

Common fees that contribute to the closing costs include, but are not necessarily limited to, appraisal and inspection fees, application fees, origination fees, mortgage and title insurance fees, early repayment fees and discount points — some of which are more avoidable than others.

[download_section]

How Are Refinance Closing Costs Calculated?

If you are considering a mortgage refinance, it’s understandable that you may feel wary of the many different fees that contribute to closing costs. You are likely hoping to avoid paying some, or all, of your closing costs upfront. In order to understand potential savings techniques, let’s first look closer at what fees comprise closing costs in the first place. The following list represents the most common fees associated with mortgage refinancing closing costs, but it is not meant to be a definitive or exhaustive list.

Inspection/appraisal fees. Because your home’s value may have changed between the time of original purchase and the time of your refinancing, you will need to have it appraised. Lenders nearly always require a home inspection and appraisal as part of the standard refinancing process. It is a way for the lender to protect themselves, in the case that your home’s value has drastically changed since you first purchased it. The cost of the appraisal will likely be around $300-500.

Loan originator fee (sometimes called “application fee.” The loan originator fee is an amount that you will pay to the lender for the service of preparing your loan. This fee essentially covers the cost of all paperwork preparation and other administrative work that the lender must complete in order to process your refinancing. On average, the loan originator fee amounts to about 0.5 – 1% of the total loan amount. In some cases, there can be some room for negotiation with the amount of this fee.

VA funding fee. If you are attempting to refinance a VA loan, you will be required to pay a percentage of your original loan back to the U.S. Department of Veterans Affairs. The actual percentage can vary based on a number of factors. On average, this percentage typically falls somewhere between 2% and 4%. There are some homeowners who will not be required to pay this fee — for example, those who receive disability payments from the VA, veterans’ spouses who receive Dependency Indemnity Compensation, and active duty recipients of the Purple Heart are all exempt from paying this fee.

Title insurance fees. When you originally purchased your home, you came into possession of the title. Property titles are typically held as public record in courthouse records. During the refinancing process, the lender will track down and inspect your title in the government records. This search is done to verify that you are indeed the legal owner and to determine if there are any liens against the property. Title insurance exists to protect the lender, and on occasion, you, the homeowner, as well. It covers the costs should there be any errors in the title investigation process. The cost of title insurance will depend on a variety of factors, including down payment amount, loan amount, and property location, among others.

Mortgage insurance fees. Mortgage and title insurance can be some of the more costly elements of refinancing. The amount that you owe for mortgage insurance will vary depending on several factors, including what type of loan you are refinancing from and what type of loan you are refinancing to.

For example, if you are refinancing an FHA loan into another FHA loan, this will come with a fee of only about 0.01% of the loan amount. If you are refinancing an FHA into another type of loan, the fee amount is 1.75% of the loan amount.

For homeowners who are attempting to refinance a conventional loan, there will be a few different options for paying the mortgage insurance fee. If you put less than 20% down on your original mortgage, you will be required to pay for private mortgage insurance (PMI). Lenders rely on PMI to protect themselves in case of default on the loan. In general, the cost of PMI is calculated to be somewhere between 0.55% and 2.25% of the original loan amount. The cost of PMI will depend on several different factors, including the size of the mortgage loan, your credit score, and the amount of your down payment, among others.

Early repayment fees. Early repayment fees can occur when you pay off your mortgage too quickly. Most lenders prefer that homeowners pay off their mortgages slowly, which allows the lender to collect more money in interest. Early repayment fees essentially function as a way to encourage homeowners to take their time in paying off the amount of their mortgage loan. In general, early repayment fees are only applicable within the first few years of homeownership. If you are going to inflict an early repayment on yourself through the refinancing process, then refinancing may not be the best option for you.

Discount points. Discount points are an optional course of payment that some homeowners choose to take. Discount points essentially allow you to buy “points” from your lender in order to obtain a lower interest rate. One discount point is worth 1% of your total loan amount. Generally, the benefit of buying points will depend on your overall loan amount as well as the length of time that you plan to spend in the home. You will have to do some calculations to figure out your “break-even” time frame for any discount points purchase.

Sometimes, lenders will charge you for discount points without reducing the interest rate simply as a tactic to charge you more money. If you did not agree to purchase points but you see them in your refinancing costs, this can be a point of negotiation between you and the lender.

Credit report fee. Lenders will want to check that there has not been a significant change in your credit score since you first purchased your home. As a result, many lenders will require that you undergo a credit report check during the mortgage refinancing process. The average credit score report will cost between $20 and $50.

Attorney fees. Most lenders rely on attorneys to ensure that all refinancing is done legally and accurately. In some cases, homeowners are required to pay for the legal costs associated with the refinancing of their mortgage. In addition, some homeowners may also want their own legal representation with them throughout the refinancing process. In either case, attorney fees are another common cost associated with closing, and often times the responsibility for covering these fees will fall on the homeowner.

How Can I Reduce My Closing Costs?

If you’ve decided to refinance your mortgage, it’s likely that you want to do so in the most efficient, cost-effective way possible. Because a mortgage refinance is ultimately a service provided to you by the lender, the lender is naturally going to charge you for this service. Consequently, it is difficult for homeowners to avoid paying closing costs entirely. However, there are some common strategies that homeowners can deploy in order to negotiate closing costs that are most agreeable to them. These strategies can include but are not limited to, comparing rates, improving your credit score, increasing your savings, getting (and staying) organized, choosing the right loan term, and negotiating with your lender.

Improve your credit score. Reducing your overall credit debt will make your case look less risky, and therefore, more attractive to potential lenders as you consider refinancing. Your credit score can be a significant determinant as to your mortgage interest rates, so getting it in the best possible shape before you refinance is always a good idea.

There are several common, relatively simple steps that you can take to improve your credit score. Nearly all of the major lenders rely on the same criteria when evaluating a credit score: payment history, credit balance, credit history, age of credit, and credit inquiries. The most influential of these factors is generally understood to be payment history — so, if you want to raise your credit score, the most important thing you can do is consistently make your payments on time.

Increase your savings. Building up the money you have in savings can impact your mortgage refinance. Some lenders will look more favorably on homeowners with greater savings in the bank. Often, lenders will consider you less of a risk if you have more money in savings. This perception of risk can have an impact on lowering your interest rate during the refinancing process.

Organization. During a mortgage refinance, you, the homeowner, will likely have to act as your own advocate throughout the process. Because of this, it’s a good idea to be as organized as you can be. This means staying on top of all of your paperwork, like your title, your credit score, your savings, etc.

Make sure that you have a thorough understanding of your own finances and financial history, and that you have the paperwork in hand to support that understanding. The more prepared you are on a personal level, before you begin the refinancing process, the more confidence and knowledge you will have to negotiate effectively with your lender.

Choose the right loan term for you. Each homeowner will have their own needs and their own criteria when it comes to choosing a loan term. As a general rule of thumb, shorter loan terms tend to come with a higher monthly payment but a lower interest rate than a longer-term loan. As you evaluate your mortgage refinancing options, be sure to consider the length of time that you plan to own your home — this will likely be the single most important determining factor for selecting your loan term.

Negotiate with your lender. During a mortgage refinancing, it’s certainly possible to negotiate with your lender. This is true when it comes to closing costs and it is especially true if you choose to refinance with your current lender. Because industry-wide low interest rates have created immense competition among lenders in recent years, your current lender may be willing to negotiate on closing costs in order to retain your business as a customer. In some rare cases, your lender may even be willing to cover closing costs themselves to keep you, the homeowner and customer, loyal to them.

Is A No-Closing-Cost Refinancing Right For Me?

On the surface, many homeowners may assume that any scenario in which they can reduce and/or delay the payment of their refinancing closing costs is automatically beneficial to them. In fact, this is not necessarily the case. The phrase “no-closing-cost refinancing” is really a misnomer, as there are still costs. This title simply means that, instead of paying the closing cost fees upfront (typically about 2% – 5% of the total amount of the mortgage loan), the lender will roll those costs into either your interest rate or monthly payment.

As a result, the advantages and disadvantages of a no-closing-cost mortgage refinance will vary greatly from homeowner to homeowner, depending on the needs, the plans, and/or the lifestyle specific to each homeowner. There are a few factors that you, the homeowner, can consider to assess whether a no-closing-cost refinance will be right for you.

Many experts agree that a no-closing-cost refinancing option will be most advantageous for homeowners who plan to stay in their (refinanced) home for no more than five years. With a no-closing-cost refinance, you don’t pay anything upfront. So, if you sell your home in the next few years after the mortgage refinancing, you will have avoided spending thousands in those upfront closing costs.

However, if you are paying more than 4% or 5% interest on your current mortgage, refinancing may be a good course of action, as it will likely result in lowering that interest rate — especially for homeowners who plan to remain in their current home for many more years to come. For these types of homeowners, a no-closing-cost mortgage refinance can actually end up losing them thousands of dollars through years of higher interest rates, rather than simply paying the costs upfront.

Keep in mind that each homeowners’ motivations for having their mortgage refinanced, and what they need from the refinancing, can be nuanced, and is rarely a cut-and-dry issue. Do some calculations that are appropriate for your specific situation and be honest with yourself about how long you plan to stay in your home. Doing these two things will help you to assess whether a no-closing-cost option is really the best course of action for your mortgage refinancing.

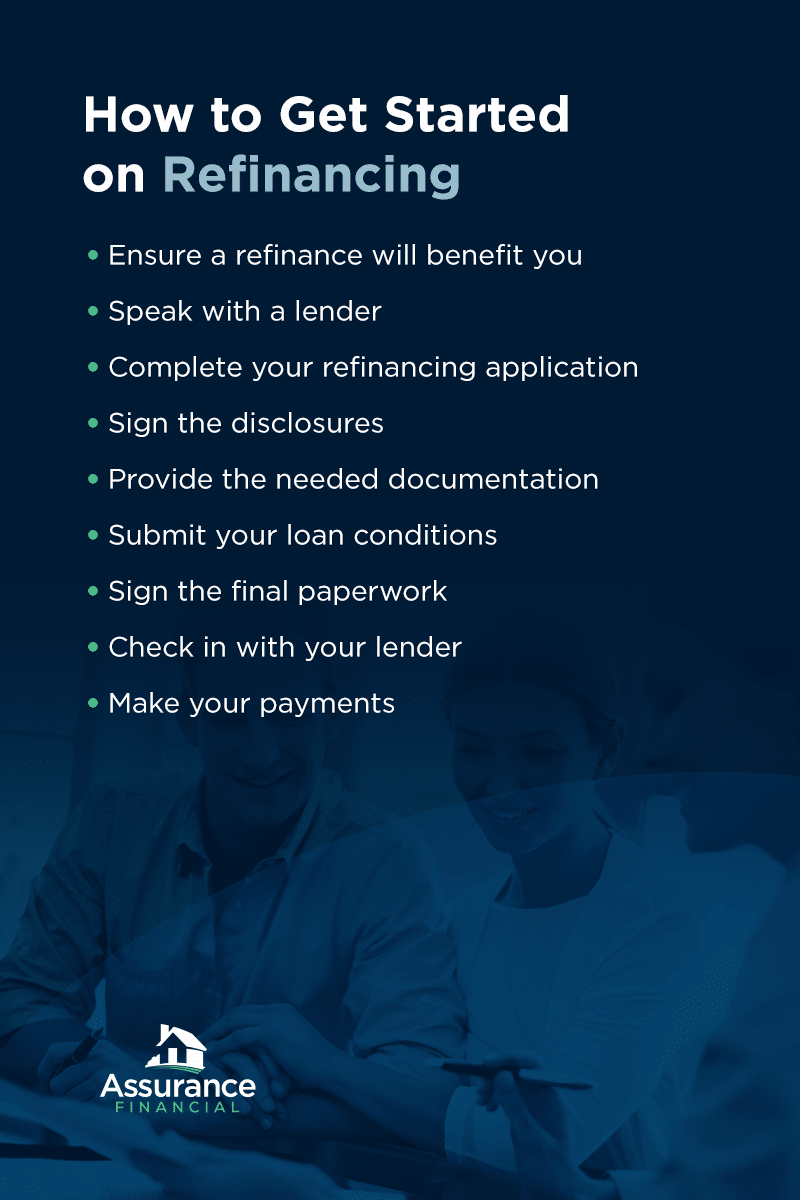

Apply For A Mortgage Refinance

The mortgage refinancing process can, understandably, feel complicated and overwhelming. For homeowners who are especially concerned about saving money and reducing the financial burden of their mortgage, it can be difficult to know whether a no-closing-cost refinancing is really the best option. Luckily, experts like Assurance Financial provide efficient, professional refinancing services and can assist you along every step of the mortgage refinancing process

Assurance Financial prides itself on its people-first, service-oriented approach to home buying and mortgage refinancing, among other services. We are an independent, full-service residential mortgage banker. Clients can feel confident in our expertise and experience. As seller/servicer approved for Fannie Mae and Freddie Mac, and issuer-approved for Ginnie Mae, we are able to underwrite them all in-house– no need to worry about outsourcing your loan details. In addition, we are experienced with every type of home financing available on the market, including, but not limited to VA loans, FHA loans, construction loans, non-QM loans, and modular home financing.

Clients of Assurance Financial can expect excellent results from our handling of their refinancing. Many of our clients achieve lower monthly payments, consolidated debt and elimination of PMI. Some are able to pay off their mortgages faster while increasing their home’s equity. With Assurance Financial holding an average rating of 4.9/5 stars from thousands of reviews, our prospective clients can feel confident in our twenty years of professional experience, our exceptional customer service, and our comprehensive expertise on all aspects of the home buying and mortgage refinancing processes.

Our many accolades speak to the quality of our services. We are proud to be A+ rated by the Better Business Bureau. From 2014-2018, we’ve been named “Best Places to Work in Baton Rouge” by Business Report. In addition, Social Survey named us “Top Mortgage Company for Customer Satisfaction” in 2019, and we were included in Mortgage Executive Magazine’s list of the “50 Best Mortgage Companies to Work For” in 2020.

It is our pleasure to assist so many people in achieving their dream of homeownership. Contact us today, and we will do everything we can to help make your mortgage refinancing a reality!

Sources:

https://themortgagereports.com/16096/refinance-mortgage-rates

https://www.mortgagecalculator.org/helpful-advice/what-is-a-refinancing.php

https://www.rocketmortgage.com/learn/no-closing-cost-refinance

https://www.nerdwallet.com/article/mortgages/refinancing-home-hidden-fees-points-commissions-to-watch-for

https://www.rocketmortgage.com/learn/mortgage-origination-fee

https://www.nerdwallet.com/article/mortgages/pmi-private-mortgage-insurance

https://www.rocketmortgage.com/learn/prepayment-penalty

https://www.bankrate.com/mortgages/low-cost-refinance/

https://www.investopedia.com/how-to-improve-your-credit-score-4590097

https://www.forbes.com/advisor/mortgages/no-closing-cost-refinance/

https://assurancemortgage.com/refinance-your-home/

https://pro.experience.com/pages/company/assurance-financial

https://assurancemortgage.com/legal/

https://assurancemortgage.com/about-us/

A mortgage usually lasts for 15 or 30 years, but that doesn’t mean you have to have the same home loan for several decades. Some people choose to refinance their mortgage at some point, either to take advantage of lower interest rates or change the loan length. Some take out home equity loans or lines of credit, which let them borrow against the value of their home. With a home equity loan and a primary mortgage, you effectively have two loans on your home.

Mortgage consolidation gives you the option of merging multiple loans into one. It’s a good way for some people to save money or get a little more breathing room in their monthly payments. Learn more about the mortgage consolidation process and see if it’s right for you.

What Does It Mean to Consolidate Mortgages?

Debt consolidation merges multiple debts into a single loan. When someone decides to consolidate their debt, they apply for a new loan and use the principal to pay off the remaining balances on their existing loans. Once the existing loans are paid in full, the borrower is left with only the consolidation loan.

When someone decides to consolidate mortgage debt, they are usually doing one of two things. In some cases, consolidating mortgages means refinancing an existing home loan and using it to pay off a primary mortgage and a home equity loan or second mortgage.

Another option is for a person to refinance their current mortgage and use the new home loan to pay off their current mortgage and other types of debt, such as a car loan or credit card debt. If someone decides to do that, they can apply for a cash-out refinance.

With a cash-out refinance, the borrower applies for a new mortgage for an amount that is more than what they currently owe. For example, someone who currently owes $100,000 on a mortgage for a house worth $200,000 can apply for a cash-out refinance of $150,000. The first $100,000 pays off the balance on their existing mortgage. They can use the remaining $50,000 to pay off other debts.

While consolidating debt by refinancing or combining two mortgages into one can be the right option for some borrowers, there are some risks to consider. For instance, when you use the proceeds from a consolidation refinance to pay off unsecured debt, such as a credit card, you are putting your home on the line. If you have difficulty repaying the new mortgage, you could lose your home.

Mortgage consolidation isn’t free, either. Just as you paid closing costs when you purchased the home initially, you’ll need to pay more fees when you refinance.

Should You Combine Two Mortgages Into One?

Before you decide to combine your mortgages or refinance to pay off other forms of debt, here’s what to consider:

- How long you plan to stay in your home: The longer you plan to live in your current home, the more sense a consolidation refinance makes. If you refinance now but plan on moving in a year or two, you risk not recouping the refinance costs. Before choosing to refinance and consolidate, use a calculator to figure out your breakeven point and to see how much you could save if you go forward.

- The cost of the refinance: Another thing to consider when consolidating home loans is the total cost of the refinance. Exact costs vary based on the location and your home’s value, but they tend to average around $5,000. You’ll need to have that money upfront when you close on the loan unless you decide to roll it into the interest rate you pay, which might defeat the purpose of refinancing.

- Your credit score: Just as the lender checked your credit before approving you for the first mortgage, they’ll check your credit again when you refinance. The higher your score, the better the terms you’ll get on a refinance loan. If you’ve had difficulty paying your loans since taking out your first mortgage, that can affect your eligibility for the best terms on a consolidation loan. Depending on your situation, you might need to focus on improving your score before you can refinance. You can improve your score by reducing your total debt and by getting current on your payments if you’ve fallen behind.

- The interest rates you’re currently paying: It’s a good idea to be sure you’ll actually save money by consolidating your mortgages or other debts. Take a look at the interest rates on your existing loans and compare them to the rates a lender is likely to offer you. Ideally, the new rates will be lower than your current rates. If not, consolidation probably doesn’t make sense for you.

- Your home’s value: The value of your home determines how much you can borrow and whether you can borrow enough to pay off your other debts. Ideally, your home will have increased in value since you bought it, meaning you owe significantly less on it than it’s worth. For consolidation to work, the home’s value must be more than what you owe on the primary mortgage and what you owe on a second mortgage or other debts. An appraisal is part of the refinancing process. If the appraiser doesn’t value the house high enough, refinancing is off the table.

Keep in mind that other debt consolidation options don’t require you to refinance your mortgage. If you’re looking to get a better rate on high-interest credit card debt, you might be eligible for a balance transfer card with a 0% introductory rate. A consolidation loan that doesn’t involve merging your other debts with your home loan is another possibility.

[download_section]

How to Combine Two Mortgages

The process of consolidating your home loans or refinancing to consolidate other forms of debt will be very similar to getting a mortgage for the first time. Shop around for the best loan options and make sure you put your best application forward:

1. Review Your Refinance Options

Before you start the consolidation process, read up on the different refinancing options available. Generally, there are two categories of refinancing. The first is a rate and term refinance. When you apply for a rate and term refinance, you change either the interest rate or the length of the mortgage, or in some cases, both. You can take advantage of a lower interest rate, which usually means lower monthly payments.

If you change the term, you can either get lower monthly payments if you extend from a 15-year to a 30-year mortgage, or higher payments, if you switch from a 30-year to a 15-year loan. Usually, a rate and term loan won’t pay out enough for you to use it to consolidate multiple mortgages or other debts.

If you’re planning on consolidating multiple debts, you’ll likely want to apply for a cash-out refinance. With a cash-out refinance, you can tap into the equity in your home. The amount of a cash-out refinance is higher than what you owe on the current mortgage, so you can use the extra money to pay off other loans.

To get a cash-out to refinance, you need to have a certain amount of equity in the home. Usually, a lender won’t agree to lend you more than 80% of the home’s value. So if you currently owe 80% or more on your home — for example, you owe $180,000 on a home worth $200,000 — a cash-out refinance is most likely not an option.

2. Apply for the Refinance Loan

Once your credit is where you want it to be, you’ve chosen the type of loan you want and you’ve found a lender who’s giving you the best rate, it’s time to finalize the application. Applying for a refinancing or consolidation loan may be a lot like applying for a mortgage the first time around. Your lender will want to see proof of income, assets and employment. They are likely to call you to verify information or to ask for additional documentation as needed. They might also call your employer to confirm your employment history.

3. Get an Appraisal

An appraisal is usually part of the refinancing process. During it, a third-party appraiser will visit your home to determine how much it is worth. The appraiser will look at the price of similar homes that sold recently and evaluate your home’s overall condition. Ideally, they will determine that your home is worth much more than you plan to borrow. If the home appraises low, you might not be able to refinance.

4. Close on the New Loan

The closing process when you refinance is also similar to the closing process when you got your mortgage the first time around. You’ll need to bring a cashier’s check or wire the closing costs to the lender. You’ll sign a lot of documents, agreeing to the new mortgage.

If you’ve got a cash-out refinance at the end of the process, your lender might present you with a check for the amount that’s above what you owed on the first mortgage. You can use the money to pay off a home equity loan, line of credit or otherwise pay off your debt. Now, you’ll just have the single mortgage payment to focus on monthly.

Benefits of a Consolidated Home Mortgage

Consolidating mortgages or other loans can seem like a lot of work. You might be wondering if it’s worth the time and effort. While everyone’s situation is different, there usually are several benefits to consolidating your mortgage, including:

1. Lower Interest Rate

Depending on when you took out your first mortgage and when you applied for a home equity loan or line of credit, you might be paying interest rates that are considerably higher than what’s available now.

For example, if you bought your home in September 2008, your interest rate might be hovering around 6%. If you got a home equity loan a decade later, in 2018, you might be paying a rate of around 4.5%. If you refinance in 2021, you can get a rate just under 3%, which will lower your interest costs on both loans considerably and can help you pay off the loans more quickly.

If you’re going to consolidate other forms of debt with higher rates, you stand to save even more. For example, a credit card might charge 20% or so in interest. Using a cash-out refinance to pay off that card and getting a rate around 3% or 4% can mean significant savings on your part.

The change in interest rate doesn’t need to be dramatic to benefit you. Even a 1% change can mean major savings on your end when you refinance and consolidate your loans.

2. Switch From ARM to Fixed-Rate

Two types of interest rates are available when you take out a mortgage or home equity loan. A fixed interest rate stays the same throughout the loan’s term. If the rate is 3% on the first day, it’s 3% on the last day. A fixed-rate mortgage offers you predictability and stability.

An adjustable-rate mortgage has an interest rate that can change over time. Often, the rate is the same throughout an introductory period, such as five or seven years. When the introductory phase ends, the rate adjusts based on the market and current conditions. It can skyrocket, bringing your monthly payment up with it. The only way to get out of an adjustable rate is to refinance to a loan with a fixed rate.

There are some reasons to consider taking out a mortgage with an adjustable rate, such as a lower initial interest rate. Taking advantage of the lower rate initially, then refinancing just before it adjusts, can help you save money.

3. Shorter Loan Term

How long you have to pay back your mortgage influences a few factors. Shorter-term mortgages, such as a 15-year loan, often have lower interest rates than longer-term home loans. A lender takes on less risk when someone agrees to pay back their loan in 15 years versus 30 years.

The term of the mortgage also determines the monthly payment. A 15-year loan has a higher monthly payment than a 30-year loan since you’re paying the mortgage down in half the time. The advantage is that you pay less in interest, and you get out of debt sooner. If you can afford a higher monthly payment and want to be debt-free earlier, it can make sense to consolidate your loans in a mortgage with a shorter term.

4. Lower Monthly Payments

It could be the case that you took out a 15-year mortgage and a home equity loan and now find the monthly payments to be a bit higher than you’re comfortable with. You’re not struggling to make the payments, but you would like some more wiggle room in your budget. In that situation, it can make sense to switch from a 15-year loan to a 30-year loan. You’ll have more time to pay back the mortgage and will end up paying more in the long run.

You’ll also have more cash in your bank account each month since you’ll owe less. You can use the savings to establish an emergency fund, save more for retirement or save for your children’s education. You also have the option of paying more toward your mortgage debt monthly.

Some people find that refinancing to a 30-year loan but continuing to make payments as if they have a 15-year loan gives them the freedom to get debt-free sooner and pull back and save their cash if they have a change in income or another change in their financial situation.

5. Simpler Payments

Variety might be the spice of life, but you really can’t put a price tag on simplicity. When you refinance your home loan and use the cash to consolidate your loans, you end up with one monthly payment. You don’t have to worry about juggling due dates or making sure all your bills get paid on time. You only have to make a single payment and only to one lender.

When you simplify your payments, you reduce the chance of missing bills, which can help you boost your credit. You also get more time in your schedule to focus on the things that matter to you.

Finally, simplifying your debt payments can help to improve your stress levels. You won’t have to worry about whether you scheduled a payment or missed a deadline. When you streamline your debt payments, you can focus more on other financial issues and goals, such as saving for the future.

6. Gets Rid of Private Mortgage Insurance

Depending on the type of home loan you have and how much you put down when you borrowed, you might have private mortgage insurance payments (PMI) to pay each month. If you have an FHA loan, those payments are for the life of the mortgage, meaning you can get rid of them if you refinance. Eliminating PMI can reduce your monthly payments and help you get out of debt sooner.

Refinance or Consolidate With Assurance Financial

Is a cash-out refinance right for you? If you’d like to consolidate a home equity loan and a primary mortgage or have other debts you’d like to roll into your mortgage payment, refinancing can be the right call. Assurance Financial makes it easy to see if refinancing is a good option for you. You can start the application process with Abby, our virtual assistant, in just 15 minutes. Apply today and take the first steps toward simplifying your financial life.

Linked Sources:

https://assurancemortgage.com/refinance-your-home/

https://assurancemortgage.com/calculators/should-i-refinance-my-mortgage/

https://myhome.freddiemac.com/refinancing/costs-of-refinancing.html

Wondering how many mortgages you can realistically get on a single residential property? Whether you want to finance your first home or you already have an existing mortgage and you’re looking for ways to refinance your home, you might be wondering about the number of mortgages you can take out on one property.

In this article, find out everything you need to know about mortgages and how different mortgages interact with one another. Also, learn how to get multiple mortgages on one property and the pros and cons of having more than one mortgage on the same property. In addition, we share tips to help you decide if getting more than one mortgage is a good move for you.

Furthermore, we’ll also explain how to qualify for multiple mortgages and offer alternative home financing options you can take advantage of instead of getting multiple mortgages on your home.

How Many Mortgages Can I Get at the Same Time?

How many mortgages can you have on one property at the same time? Generally, you can get a maximum of two simultaneous mortgages on a single property. You will have a first mortgage — called the first-position mortgage — and you can get a second mortgage — called the second-position mortgage.

But how do multiple mortgages work, and what do these positions mean?

How Do Mortgages Work?

Mortgages on your home are usually considered individual loans and analyzed in terms of positions. The position — called lien position — of each mortgage is the order of priority with which the law will recognize the lenders’ claims against property in foreclosure.

A lien refers to the lender’s right to seize and possess a property when a borrower defaults on their repayment. The lien position of a mortgage determines its priority as well as when it gets paid in a foreclosure.

This means that in a foreclosure, after selling the house, the first-position mortgage gets paid first. Then the remaining money is used to pay the second-position mortgage. Third-position mortgages are rare. But why is it that you can’t generally get more than two mortgages on your home?

Why You Can’t Get More Than Two Mortgages

Finding a bank that is willing to take the third lien position for a residential home is difficult, if not impossible. And even if a bank or lender decides to give you a loan for a third mortgage, the rates may be astronomical — for good reasons — so you may not be able to meet the demands.

The reason is that third-position mortgages get paid last in foreclosures and may sometimes not get paid at all. Banks may not be willing to take up this kind of risk.

For example, in the great financial crisis of 2008 and 2009, there was a 120% increase in foreclosures from the previous years, and many second-position lenders didn’t get paid in foreclosures. That’s not to speak of the third position mortgages. Because of the high risk involved in giving out loans for a third mortgage, banks generally do not give third mortgages or do so at astronomical rates.

The bottom line? For a residential home, you’re open to just two mortgages.

However, getting a second mortgage on your home also comes with its challenges and disadvantages. If after taking a second mortgage you want to access more equity out of your home to fund other projects or pay an outstanding bill, there are other options that you can take in the absence of a third mortgage.

The next sections get you up to speed on how first and second mortgages work, how they interact with each other and the different types of second mortgages.

How a First Mortgage Works

As a first-time homeowner, whether you’re getting your home loan through a conventional lender, or a government-backed loan such as the Federal Housing Administration (FHA) loan, the U.S. Department of Veteran Affairs (VA) loan or the U.S. Department of Agriculture (USDA) loan, your lender provides you the money to purchase your house when you meet certain criteria.

While the criteria may vary for different lenders, you should generally expect to meet:

- A minimum credit score

- A good history of loan repayment

- A specific downpayment

- A specific loan-to-value (LTV) ratio

- A stipulated interest rate

- A repayment plan

The minimum credit score requirement varies depending on whether you’re going with a conventional loan or an FHA, VA or USDA loan. Also, a lender will expect a loan-to-value ratio, which is how much of the value of the property you want to collect a loan for, of 80% or less.

For example, to purchase a property worth $100, 000, at an LTV of 80%, the lender gives you $80,000 to purchase the property while you provide the remaining $20,000 as a downpayment.

This first mortgage will be your first position mortgage, which you repay — with added interest — on a monthly installment plan for a specified period of time. For every monthly payment that you make to pay off the principal of the loan, your share of the house — the equity — increases. Once you pay off the entire loan, the property is completely yours.

When you build up enough equity, you can use that to get a second mortgage on your property.

What Is a Second Mortgage and How Does It Work?

You may get a second mortgage from the same lender or a different lender. Whether you get a second mortgage from the lender of your first mortgage or from a different lender, the loan from a second mortgage does not have any use restriction.

You can use the money you get from a second mortgage for anything you want — many use it to invest money back into their home in the form of necessary repairs or aesthetic upgrades, which in turn ups the resale value. You can convert the home equity from your monthly mortgage payment to pay off a heavy credit card debt, fix damages in your house, pay off school loans or other heavy financial projects.

When you take the second mortgage on your property, the lender takes a lien against a portion of your home equity. The lender then gives you a loan equivalent to the value of the equity that you mortgaged.

The requirements for getting a second loan vary for different lenders. Generally, a second mortgage lender would only give you a loan for a portion of your equity on your property. This practice is to ensure you retain a level of ownership on the property — usually at least 20% equity on your property.

Also, the lender may require a debt-to-income (DTI) ratio — the portion of your gross income that you use for paying off debts and loans — of 43% or less. Other conditions like credit score and interest rates depend on the lender.

Here’s the interesting part. Apart from paying off your first mortgage, your home equity can increase if the value of your home increases. For example, when you make major repairs on your property, the value of the property increases. The increase is added to your equity that you can use to get any one of the two types of second mortgages.

Types of Second Mortgages

For a second mortgage on your home, you can either get a home equity loan or a home equity line of credit (HELOC).

What Is a Home Equity Loan?

A home equity loan is cash equivalent to the portion of your home equity you want to mortgage. The loan is given to you as a lump of cash to spend for whatever you want.

For example, after getting 50% equity on a $100,000 property, you can get a home equity loan for 60% of your equity. This will be equal to $30,000 given to you in cash.

The home equity loan becomes a second-position loan. And alongside your first-position loan, you have to make monthly payments for a specific period of time to pay off the principal and an added interest.

What Is a Home Equity Line of Credit Loan?

A HELOC is just like a credit card. Instead of the lump of cash — given to you in a home equity loan — you get a line of credit equivalent to the portion of your equity you want to mortgage.

To access your HELOC loan, you may receive a credit card or special checks. An interesting thing to note is a HELOC loan is a revolving loan. This means whenever you pay off the balance on the loan, you have access to the full line of credit again.

For example, if you take a HELOC for 60% of your 50% home equity in a $100,000 property, you’d get a $30,000 line of credit. If at any point you spend $10,000 out of the line of credit and pay it back within the time period, you can access the full $30,000 again. And because HELOC loans are not a lump of cash given to you, you don’t have to make regular monthly payments until you start utilizing the line of credit.

However, you can only make use of the line of credit during a specified period of time called the draw period. After the draw period, you can not access the line of credit anymore and you have to repay the loan balance in full. If you fail to repay the balance after the draw period, the lender has the right to seize your home.

It’s easy to mistake a second mortgage with a home refinance, but they are not the same.

How a Home Refinancing Works

A home refinance is when you get another loan — usually a larger loan — to pay off an existing mortgage.

You can get a home refinancing for various reasons. For example, you may find a mortgage with a better rate and you want to take advantage of it. So the new loan is used to pay off the existing mortgage and the extra value is given to you as cash. This loan is sometimes called a cash-out refinance.

Home refinancing can be a great way to switch lenders and get extra cash to use to offset other bills. Unlike car loans or school loans, the extra cash from a home refinancing can be used for anything, from funding your wedding to paying high-interest credit cards debts, school loans or funding your next project.

The Difference Between a Second Mortgage and a Home Refinance

Second mortgages and home refinances differ in two major ways. A second mortgage can be from the same or different lender, and you generally end up paying up two mortgages every month. The two mortgages have liens on your property and defaulting on one of them can lead to a foreclosure.

On the other hand, a home refinance doesn’t lead to having two separate liens on your home or paying two separate mortgages every month.

In a home refinance, you pay off a mortgage with another mortgage. You replace your original mortgage with a new mortgage that takes the first-lien position. For example, if your first loan balance is $50,000 and you find another lender with a better interest rate, you can get a $60,000 home refinance to pay off your existing mortgage balance and extra cash to put into other projects. The new loan becomes the first position loan.

Because of the conditions around getting a second loan, it may not be for everyone. How can you decide if going for a second mortgage is a good choice for you and your financial goals?

[download_section]

Is a Second Mortgage Right for You?

Getting a second mortgage has its pros and cons, but how can you tell if it’s a good move for you to get a second mortgage on your home? Consider these four questions to help you decide.

1. Do You Have a Steady Source of Income?

If you have a steady source of income and you know you can pay for two mortgages every month on time without defaulting, then getting a second mortgage might be a good move for you.

It is crucial to be sure you can comfortably pay off both mortgages to ensure you don’t lose your home. If, for example, you’re living from paycheck to paycheck, getting a second mortgage may not be the best move for you.

2. Do You Have Heavy Credit Card Debts?

If you have heavy credit card debts piling up that might affect your credit score and your ability to access credits in the future, getting a second mortgage on your property can provide you the cash you need to clear your debt and other bills and give you a strong financial standing.

3. Do You Have Enough Equity on Your Property?

If you’ve gathered enough equity on your property, you can use it to access more loans or lines of credit to fund a project or pay off credit card debts instead of leaving it to lie fallow.

4. Is a Cash-Out Refinance Not Possible for You?

If you can’t get a cash-out refinance for your property and you need a loan, you can go for a second mortgage to get the funds that you need.

Pros of Getting a Second Mortgage

Here are four pros of getting a second mortgage on your home.

- Second mortgages often have better interest rates than credit cards: Second mortgage interest rates are usually less than credit card rates. So getting a second mortgage to pay your credit card debts can help build your credit score as well as provide you with a less demanding loan.

- You can use loans from second mortgages for anything: Unlike school loans, business loans or car loans, there’s no restriction to what you can use the loans from a second mortgage for. Compared to your first mortgage and other forms of restricted loans, this is a lot of freedom.

- You can access high loans with second mortgages: You can access high loan amounts at good rates with a second mortgage. For example, based on your lender and how well you meet other lending requirements, you can use as much as 90% of your home equity for your second mortgage.

- Getting a second mortgage help you make better use of your home equity: Instead of tying down money in your property, you can use the equity you’ve gathered over the years in your home to access loans that you can use for paying off credit card debts, other loans or funding your personal projects.

Cons of Getting a Second Mortgage

Second mortgages come with their own set of challenges. Here are four cons of getting a second mortgage for your home:

- Second mortgages usually have higher interest rates than refinancing: Because second mortgages take the second lien position in a foreclosure, lenders are taking a lot of risk in giving you a loan for the second place in your line of mortgages. So to compensate for that, they may demand higher interest rates than the first mortgage or a refinance.

- Second mortgages are financial disturbances: Especially if you’re already struggling with the first mortgage, adding another mortgage can put lots of pressure on your finance, bite deep into your budget and possibly lead to defaulting in your primary mortgage or both.

- Second mortgages can take you back: Especially if you’re close to paying off your current mortgage, a second mortgage might pull you right back into the debt track and put your home at stake if you default on your monthly payment.

- Second mortgages can be money traps: Because of the freedom of use of the loans from second mortgages, it is possible for you to spend it on projects that put you in more debt.

When Is a Third Mortgage a Good Idea?

If you are able to find a lender that will offer you a third mortgage on your home, you likely fit a very specific set of criteria:

- Your first and second mortgages have low principal balances.

- You have sufficient equity on your home.

- You have good credit and repayment history.

A third mortgage would make financial sense if you can find one with favorable terms and your first two mortgages would incur a hefty prepayment penalty. However, since you can consolidate loans, third mortgages are extremely rare.

Putting Everything Together

You can get at most two mortgages at the same time for your home in most cases. Depending on the lender you work with, the interest rates and requirements may vary.

Also, instead of a second mortgage, you can go for a home refinancing to access more loans without taking on more mortgages on your property.

Contact Assurance Financial for Your Home Loan

Whether you are a first-time homebuyer, or you’re looking for a second mortgage or home refinancing loan, Assurance Financial can help you get the home financing and mortgage to meet your needs.

Our in-house loan officers will work with you to underwrite your loan. We’re an independent residential mortgage banker, which means we can underwrite your loan in-house and don’t have to outsource to another banker.

We provide end-to-end in-house processing of your loan and application technology that makes getting your loan fast and simple, no matter the type of loan.

You can start by applying online with Abby or contact us to speak with a live agent.

Linked sources:

Owning a home may be the American dream, but paying off your mortgage early seems more like a far-fetched fantasy. We have good news. It isn’t, and paying off your mortgage early could help you save thousands of dollars in interest, get rid of big monthly payments, and live lien-free! By understanding the process and having the proper plan, it’s even possible for young homeowners to pay off their mortgage by 30.

Regardless of your age, there are ways to turn your paid-off mortgage fantasy into a reality. We’re going to break down the steps, answer some of your most pressing questions and help you take the next step toward your financial freedom!

To understand how paying off your mortgage early works, let’s look at how your current payments are set up. When you pay your monthly bill, that money is split two ways. One-half goes to the principal, which is also known as the mortgage balance. The other half goes toward paying the interest, which is the percentage your bank is charging for them to loan you the money.

When you’re trying to pay off your mortgage early, you can contribute additional funds to the principal balance, which then reduces how much you owe and shortens the timeline of repayment, resulting in fewer interest payments.

Let’s say you’re buying a home and you take out a 30-year fixed mortgage for $125,000 with a 4 percent interest rate. Your payment would be around $596.77 a month, but over the life of the loan, you’d end up paying close to $89,836.59 in interest. That’s on top of the amount you originally borrowed, turning a $125,000 loan into a $214,836.59 one.

Now let’s say you decided to pay an extra $100 a month on this same mortgage, interest and term length. Now, instead of paying $89,836.59 in interest by the end of the loan, you would have to pay $65,806.74. That small monthly boost saves you $24,029.85! It also shortens your loan term by 86 months and leaves you with a new total of $190,806.74. So, with just an extra $100 a month, you save 27 percent in interest and pay it off 24 percent faster.

This is only one example of early mortgage repayment, so we’re going to explore other methods and scenarios that may work better for you. But before we break down how you can do it, it’s valuable to ask yourself if you should do it. Not all experts think that paying off your mortgage early is as sweet a deal as it sounds. Keep reading to find out why.

Should You Pay Off Your Mortgage Early?

Just because you can do something, doesn’t mean you should, and the same goes for where to put your extra cash. Some people might ask, “Isn’t getting out of debt a good thing?” but they’re asking the wrong question. It can be a good goal for some and the wrong goal for others, and knowing the difference requires case-by-case examination.

Each person’s finances come with a wide range of variables, such as income, expenses, debts, interest rates, credit scores, and the bank being used. Taking financial recommendations and holding them up to the light of your own circumstances is an important part of planning your financial goals.

Sometimes the perks of paying off your mortgage early don’t outweigh the opportunity of putting your cash to work somewhere else. So, without any clear “should you” or “shouldn’t you,” let’s investigate the benefits and the risks of early mortgage repayment and how they may apply to your finances.

Benefits of Early Repayment

The first benefit of paying your mortgage off early is that it can save you money in interest fees. As we’ve demonstrated, paying more each month or refinancing for a shorter term with a better rate could save you thousands of dollars! Those are some significant savings. The best part is, it doesn’t take much to see those kinds of positive results.

In our original scenario, we only bumped up the payment by $100 and it saved you $24,029.85 in interest and shortened your loan term by 86 months. Imagine if you doubled that? At $200 extra a month, you’re looking at $52,117.49 in interest savings and paying off your loan 137 months sooner. That’s 11 years and 5 months saved. Can’t swing the $100? Cut that in half and you’re still saving $13, 978.59 and saving yourself 4 years of payments. A little goes a long way!

Paying off your mortgage sooner also frees up money in your monthly budget later in life. With your mortgage bill gone, you could contribute that monthly amount to any number of things, such as other debt, your 401k, Roth IRA, HSA, your emergency fund, or other investment opportunities. It could allow you to spend your later years doing the things you’ve always wanted to do, like travel or take up an interesting hobby. Dreaming of ways to spend that monthly payment can be a real motivator to pay off your house early!

Some people weigh the value of early repayment against missed investment opportunities. While stocks typically have a greater return, they’re not always reliable. The market can be volatile, but your mortgage payment is showing up no matter what the market’s doing. So if you have $100,000 in investments and the market takes a turn, your portfolio could take a devastating hit. Unfortunately, your lender isn’t going to adjust your bill accordingly. Mortgages have fixed liability, so no matter what happens to you, your loan is still gonna be due.

Few people regret getting out of debt. You could gain even more by putting your extra money elsewhere, you probably won’t wish that you still had a mortgage when it’s finally gone. When considering repayment, numbers play an important role in our deliberation, but we can’t ignore the emotional and psychological impact of financial decision-making. Since the stock market isn’t guaranteed to give you predictable returns, the psychological benefit of owning your home free and clear cannot be easily dismissed!

Risks of Early Repayment

While there are plenty of benefits to early repayment, there is a fair share of risks as well. Your mortgage may not be the best loan to pay off first. You should prioritize other high-interest debts, like credit cards and student loans before your home. Your interest savings on your mortgage will pale in comparison to what you could save if you paid off your other debts first.

Some people make good use of the snowball method, which is based on the idea of a snowball rolling down a hill and growing in speed and size as it goes. Financially, this looks like paying extra on the debt with the highest interest rate and working down the list until you’re paying off the lowest interest rate.

So let’s say you have a credit card with a $5,000 balance and a 16 percent interest rate, a student loan balance of $7,500 with a 7 percent interest rate and your $125,000 mortgage at a 4 percent interest rate. Following the snowball method would look like paying the credit card first, followed by the student loan, and then the mortgage. This way, you’re saving the most on interest payments.

But before you even start the snowball method, you should be sure to have a healthy emergency or rainy day fund for any unforeseen expenses. Without one, you may end up accruing more high-interest debt in order to cover these events, which would counteract all the work you put into paying off your original loans.

Another risk of early mortgage repayment is missing out on other investment opportunities with higher returns. While the stock market isn’t guaranteed, there is a historical basis of an average return dating back as far as 1928. While not all stocks are fool-proof, some are safer than others and can yield a return that outweighs what you would’ve saved in interest payments.

The same could be said for retirement accounts or other savings methods that use compounding interest. The sooner you save, the more money they can accrue. So if your interest rate is 4 percent but your portfolio returns an average of 7 percent, you’ll lose money by paying your mortgage off faster.

Paying off your mortgage early can also tie up the majority of your net worth in a non-liquid asset. There’s a difference between having $125,000 invested in a home and having $125,000 in cash. Smart investors try to have a balance between liquid and non-liquid assets, so if paying off your home is going to skew that balance, you may want to consider evening things out instead of wrapping up all your wealth into a house.

Imagine if you had a life event that cost you more than your emergency fund. Getting cash to cover things like losing your job, medical treatment for a serious illness or even something like starting your own business would mean you would either have to borrow against your house, which practically defeats repaying it early, or selling it, something that may not be a reasonable option if that house is the one you live in!

You also need to consider the fact that paying off your mortgage early is a long-game investment. If you, like most homeowners, have a fixed rate, then your monthly payment is staying the same until the loan is paid in full, which means you won’t see the fruits of your labors until the term is up.

If you end up quitting on paying extra, you could end up with dead equity, or money tied up in an investment that isn’t making you anything. Unless you see your early repayment through to the end, you could be wasting the money you’re using to pay off your mortgage by not investing it in something with higher returns.

Lastly, paying off your mortgage early requires sacrifices, which brings us back to the emotional and psychological aspects of this decision. It can take years to see the benefits of early repayment. Mortgages are for the long haul, and even if you cut a 30-year term in half, that’s still 15 years before you’re using that disposable income in a discretionary way.

Is Early Repayment Right for You?

You should base your financial decisions on your individual circumstances, but we can help frame some scenarios that can help you quickly decide if early repayment works for you. We’ve created two qualifications lists to review that may help you figure out if paying extra on your mortgage is a good idea.

Here are some reasons to forgo extra payments on your mortgage:

- You have other high-interest debts

- You don’t have an emergency fund

- You aren’t on track for retirement

- You’ll benefit from using your mortgage interest as a tax deduction

Conversely, here are the scenarios where paying off your mortgage early could be beneficial:

- Your high-interest debts are paid, you have an adequate emergency fund, and you’re paying into retirement

- You have a healthy balance between liquid and non-liquid assets

- You already have a healthy stock portfolio

- You have the opportunity to refinance to a lower interest rate

- Your monthly income increased

Neither of these lists covers the full scope of every possible scenario, but if your situation identifies overwhelmingly with either of these lists, then you probably have your answer on whether you should pursue paying off your mortgage early.

Ways to Pay Off Your Mortgage Early

If you’ve done your homework, reviewed your finances, and decided that paying off your mortgage is right for you, then we want to teach you some ways to make that dream a reality. There are a few different strategies for paying off your mortgage early. Choosing the best one for your financial circumstances depends on your current mortgage and how much you want to or can contribute to your efforts.

Switch to a Biweekly Payment Schedule

The first option is to switch to a biweekly payment schedule. This is a great option if you don’t have extra income in your monthly budget to contribute since your payment stays the same. You’ll just pay it in two installments. So if your payment is $596.77, as in our mortgage example from earlier, you’ll pay $298.39 one week and then another $298.39 two weeks later.

The reason this can help you pay off your house early is that it uses the weeks of the year to your advantage. When you’re on a once-a-month schedule, you end up paying 12 times on your loan. But, on a biweekly schedule, you pay 26 times a year, which affords you one extra annual payment. That means an extra $596.77 a year, which would be the equivalent of an extra $49.73 a month, and we already covered what an extra $50 months could mean for interest savings!

Increase Your Monthly Payment

We’ve already covered how paying a little extra each month can cut down your loan term and interest payments, but there are several possible ways to do it. Most lenders will let you set up an automatic deduction, though that payment would be fixed when you set it up. You could also manually pay extra each month, which may be less convenient but it allowing you flexibility in your contributions.

Several methods can help you decide how much extra you want to contribute month-to-month. It could be as simple as an arbitrary number or rounding up your monthly payment, which would look like bumping up your $596.77 payment to $600. You could also take a non-essential budget item, like a subscription service or your daily cup of artisan coffee, and spend that money on your principal instead.

Another method you could try is the dollar-a-month method. This is where you add one extra dollar a month for the life of the loan. So in the first month, you’d pay just one dollar more. But by month 86, you pay $86 dollars more.

No matter how you decide to do it, consider choosing the option that you’re most likely to stick with or can afford to see through to the end. Remember, you don’t want to risk any dead equity.

Commit Bonuses and Tax Returns to Your Loan

Another way to pay off your mortgage early is to commit any windfalls, like work bonuses, casino winnings, or your annual tax return, to repayment. So instead of adding extra to your payment per month, you’d be contributing a lump sum whenever they come in. So let’s say you get a $1,200 tax return in June and a $1,500 Christmas bonus in December. You’d simply take those checks and pay them on your principal.

This strategy doesn’t cut into your monthly budget but considers whether you have the discipline to spend your bonuses on your mortgage. Be sure to also check whether your loan has a prepayment penalty before using this strategy!

Refinance to a Shorter Loan

It’s common for home-buyers to opt for a long-term loan in order to reduce their monthly payments, but over time your financial circumstances may change for the better and you could use your increased cash flow for extra payments on your mortgage.

Refinancing is a great way to put that new or freed up cash to good use. By refinancing for a shorter loan term, your monthly payments will go up but your timeline and interest will go down. If you also qualify for a better interest rate, that could increase your savings even further!

So let’s say you have a balance of $112,839.43 on your $125,000, 30-year fixed loan with 4 percent interest and 25 years left on the life of the loan. In those five years, you’ve increased your monthly cash flow and you find out that you qualify for a better interest rate. By refinancing your house to a 15-year fixed loan with a 3 percent rate, your monthly payment of $597 goes up by $197 but you will save $39,154 in interest.

One thing we left out of our calculations is the closing costs, which can total from two to three percent of the loan. Depending on your situation, that extra percentage could offset any money you would save on interest. Even so, there are other good reasons to consider refinancing, such as consolidating debt, taking out cash on your home, or paying off private mortgage insurance.

If you’re considering refinancing, check with a lender to find out what you’re eligible for, and then use a reliable refinance calculator to crunch the numbers to see whether refinancing could help you pay off your mortgage early and save you money!

[download_section]

Refinance Your Mortgage with Assurance Financial

Of the ways to pay off your mortgage early, refinancing is the one that requires the right financial partner. But we don’t want you to settle for a loan officer who’s in it for the commission. Choose Assurance Financial instead. With over 20 years of lending experience and a 4.8-star customer rating taken from thousands of reviews, we are the partner you deserve.

In addition to our stellar customer service, we have the latest in application technology to make starting your loan simple and fast. With our end-to-end processing, as well as Fannie Mae, Freddie Mac and Ginnie Mae service approval, we do not need to outsource your loan details. We keep it all under one roof, which keeps your information safe and in one place.

Let Assurance Financial help you get a loan that fits your needs. To start your application online, apply with Abby or get in touch with one of our experts. We can’t wait to help you take the next step!

Linked Sources:

- http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html

- https://www.ramseysolutions.com/debt/how-the-debt-snowball-method-works

- https://www.forbes.com/advisor/mortgages/principal-interest/

- https://www.consumerfinance.gov/ask-cfpb/what-is-the-difference-between-a-fixed-rate-and-adjustable-rate-mortgage-arm-loan-en-100/

When you own your home, you can feel a sense of stability and security. You have a roof over your head and a place to raise a family if you choose to do so. You also get full control over how you decorate the home and any changes you make to it.

There’s another benefit to homeownership, and that’s the chance to build equity in your home. Many homeowners look at their property as an investment. If you live in the house for long enough and make enough payments on the mortgage, at some point, your property will be worth more than you paid for it. Another way that a home acts as an investment is through equity. The more equity you have in your home, the more homeowner advantages you can enjoy. Learn more about the value of building home equity and what you can do to maximize it.

What Is Equity?

Home equity is simply the difference between your home’s value and the amount you owe on the mortgage. If you own your home free and clear, your equity is the same as the property’s value. Here’s a quick example of how equity works. Suppose your home’s market value is $300,000. You have a mortgage on the home and still have $220,000 left to pay on it. In this example, the equity in your home is $80,000, or $300,000 minus $220,000.

For many homeowners, equity increases the longer they own their homes. As you make payments on your mortgage, the principal on the loan decreases. Meanwhile, the share of your equity grows.

Although equity usually goes up, it can drop. For example, perhaps you bought a home worth $300,000 and took out a $250,000 mortgage to do so. At the time of closing, your equity in the home was $50,000. Then, a recession happened and the value of homes in your area dropped. Your home now has a market value of $250,000 and you have $225,000 left on your mortgage. Even though you’ve paid off some of your loan principal, since the value of the property has fallen, you now only have $25,000 in home equity.

Why Is Building Equity in a Home Important?

Building equity in your home helps you establish financial freedom and flexibility. The greater your home equity, the better you may be able to weather financial hardships that come your way. Once you establish some equity in your home, you can use the cash value of the equity when necessary. There are two ways to tap into your home’s equity.

One option is to apply for a home equity loan. Just as your mortgage uses your home as collateral, so does a home equity loan. Usually, you can borrow up to 85% of the full amount of equity you have in your home. If your equity is $50,000, your home equity loan can be up to $42,500.

You can use the funds from the loan for pretty much any purpose. Some people use the loan to cover the cost of a home improvement project, while others use the loan to help pay for their children’s college education. Typically, you repay the loan in installments, making monthly payments until you’ve repaid it in full, plus interest. The amount of interest you pay depends on the market conditions, your credit score and how much you borrow.

The other way to tap into your home’s equity is with a home equity line of credit (HELOC). A HELOC is similar to a credit card. You have a credit limit and can borrow up to that limit. Once you repay the amount you’ve borrowed, you can borrow more, provided you’re still in the draw period.

The more equity you have in your home, the bigger your financial cushion if you need to borrow against it. It’s important not to go overboard when borrowing against your home’s equity. If you have difficulty repaying your home equity loan or HELOC, you do risk losing your home, just as you would if you can’t make payments on your original mortgage.

Even if you don’t plan on borrowing against your home, equity matters. If you’re planning to sell the property in the near future, the larger your equity, the more cash you’ll walk away from the closing table with. Having a lot of equity in your current home can mean you have more to put down on your next home. It can also help you afford a more expensive house the next time you are in the market.

How to Build Equity in Your Home

The less you owe on your mortgage, the more equity you likely have in your home. Several factors can influence the amount of equity you have, including the value of your home and the size of your home loan. While you can’t take control of the market, you can do several things to help build equity in your home:

1. Make a Large Down Payment

Although there are many programs that make it possible to get a home loan without putting down a hefty down payment, if you’re interested in building home equity right off the bat, one of the best things to do is make a large down payment.

Let’s say you’re interested in purchasing a home worth $250,000 and you’re trying to decide how much to put down. If you made a down payment of 5%, or $12,500, you would have equity of $12,500 from the start. You’d also have to make private mortgage insurance payments on the loan until you’d paid off 20% of its value.

Your equity would jump to $25,000 if you made a down payment of 10%, and your monthly private mortgage insurance payments would drop. If you can afford a 20% down payment, your equity in the home would be $50,000 from the beginning. You also wouldn’t have to make any private mortgage insurance payments, and your monthly mortgage would be notably smaller than if you put down 10% or 5%.

When deciding if it’s worth it to make a big down payment or not, there are some things to consider aside from home equity. One factor is how long it will take you to save up your down payment. If home values in your area are increasing rapidly and you have enough to put down 5% or 10%, it can make sense to buy now, even though you don’t have a full 20% down payment. By the time you saved enough to put down 20% on a $250,000 home, a property once worth $250,000 might be selling for $300,000 or more in a competitive market.

Another thing to consider is how making a larger down payment will affect your savings. It’s a good idea to have extra money set aside after you buy a house to cover unexpected repairs or to make improvements. If a big down payment will drain your savings, it may be better to save some money for a rainy day, so you don’t have to borrow additional money to pay for home-related expenses.

When buying a home, the amount people put down typically depends on their status as homebuyers. First-time buyers put down a median of 6%, while repeat buyers pay a median of 16% down.

2. Make Larger Mortgage Payments

If making a big down payment upfront doesn’t work for your budget or would put homeownership years out of reach, another way to build equity relatively quickly is to boost the size of your mortgage payments. When you closed on your home, you likely got a copy of the amortization schedule, which detailed how your mortgage payments will break down over the term of your loan, provided you made the same payment each time.

When you make a bigger-than-required mortgage payment, that schedule is completely updated, as you’ll be reducing the size of your principal and speeding up the repayment process. You’ll also be building equity in your home by reducing your debt obligation. Even paying an extra $100 per month reduces your mortgage amount, improving your equity.

You have a few options when it comes to boosting your mortgage payments. One option is to increase the amount you put towards the principal each month. Many mortgage providers give you the option of paying extra towards the principal when you schedule your monthly payment. You can choose to pay an additional $100, $500 or more each month, based on your budget.

Another way to make bigger mortgage payments is to pay more often. If you pay half of your monthly mortgage payment every other week, you’ll end up making one extra monthly mortgage payment per year.

You can also decide to make a lump sum, additional payment to your mortgage when you can. For example, if you get a hefty tax refund, you might decide to apply some or all of it toward your mortgage. If you inherit money, you can put it toward your mortgage, reducing the size of your principal and boosting your home equity.

3. Improve Your Property

Bringing down your mortgage principal is one way to raise your home equity. The second option is to increase the value of your property. The good news is that there are things you can do to improve your property and its value. Here’s how to build home equity with home improvements:

- Update the kitchen or bathrooms: Kitchens and baths tend to be the rooms that really sell homes. The better and more desirable your home’s kitchen and bathrooms are, the more you can ask for when selling it and the higher the property’s value. A minor, mid-range kitchen remodel might boost the value of your home by $18,206 and allow you to recoup about 78% of the cost of the remodel.

- Add curb appeal: Improving your home’s curb appeal can increase its value by about 7%. Think of it this way, more buyers will be interested in a property that looks attractive and inviting from the outside than in a property that looks like it’s in need of some TLC. Boosting curb appeal doesn’t have to cost a lot, either. Adding a few planters, repainting the porch and door and making sure the lawn is trimmed and trash is picked up can go a long way.

- Improve the doors: Although people often focus on the aesthetics of the home when they think about value, the bones of a home matter, too. In fact, a home with good bones and practical upgrades is often worth more than a house that doesn’t have those features. Replacing older front doors and garage doors with high-quality, more efficient options is going to raise the value of your home. When choosing replacement doors, think of efficiency and how well they seal the home to keep warm or cool air from escaping. You also want to consider security to enhance people’s feelings of safety when they are on the property.

- Fix the roof: Roofs can be expensive, and buyers are drawn to a home that has a new roof compared to a property with an old one that they might have to replace themselves. How much it may cost to replace your roof can vary based on the materials, but you can typically expect the project to boost the value of your home anywhere from $16,000 to $24,000. Many homeowners recoup about 60% to 66% of the project’s cost when they sell the property.

- Add on to the home: Size matters when it comes to home value. A three or four-bedroom home is going to be worth more than a two-bedroom home. If you have space and the budget, it can make sense to add on to the property. Building an addition can also be a good option if your family size is growing and you’re not ready to sell your home and move.

- Make energy upgrades: A home that’s energy-efficient is more attractive than one that has high utility bills. Energy-efficient homes tend to be more comfortable, even in extreme weather, than non-efficient homes. People are willing to pay more for a house with Energy Star rated appliances, low utility bills and improved comfort. Some efficient upgrades you can make include improving the HVAC system or furnace, installing better windows and replacing older appliances with more efficient models.

- Make the home safe and smart:Smart home technology streamlines people’s lives and can make your home more attractive and valuable. Installing a smart thermostat, smart lights and smart door locks are just a few of the technological updates you can make to improve your home’s value. Safety is another thing to consider. Make sure the home has working smoke alarms and carbon monoxide detectors. Most states require alarms and detectors for a home to be up-to-code.

[download_section]

4. Refinance Your Home Loan

When you first bought your home, you might have taken out a 30-year mortgage. If you’re interested in building home equity more quickly, it can make sense to refinance your loan to a 15-year mortgage. There are some key differences between the two types of loans:

- Time: You’ll repay a 15-year loan in half the time it takes to pay off a 30-year loan. That means you’ll own your home outright much sooner.