Category: Uncategorized

Selling your current home to move on to bigger and better things is an exciting milestone for many homeowners. Though you’ll miss the house that gave you so many cherished memories, you can look forward to more exciting adventures that await down the road.

However, as you approach your closing date, it’s natural to have questions about what will happen, both in the days leading up to closing and on the big day itself. The guide below will provide some tips on preparing your home and discuss the closing process in detail, so you’ll know more about what to expect on closing day.

How You Can Prepare for Closing Day

Once you’ve accepted an offer on your house, you may feel as if your process is nearly over. But closing is a considerable undertaking, one you’ll want to prepare for carefully. You’ll have a lot of work to do before you’re ready to sign the paperwork and hand over your keys.

What can you expect on closing day? Here are a few of the steps you’ll likely need to take.

1. Pack up Your Home

On closing day, one of the first things you should do is pack for your move, if you haven’t already. Depending on how long you’ve been in your current house and how many possessions you’ve accumulated, boxing everything up may be a Herculean task.

If you know you have much more to pack than you can accomplish in a single day, plan to begin the process early. Maybe you can get a head start on putting everything into boxes and disassembling some of your larger pieces of furniture at the beginning of the week. Then, when your closing day gets closer, you’ll be able to move your belongings into a U-Haul or moving van more quickly.

If you plan to hire packers and movers, you should start arranging those logistics early as well — ideally, several days before your closing date so you can have your house emptied by closing.

Schedule your packing and moving appointments, pay the fees and ensure you’re ready for the teams when they arrive. Have clear instructions prepared for how you’d like your rooms boxed up, and have your belongings packed and ready to go once the movers get there. And in all the chaos of preparing to close, remember to have extra cash on hand as well. If you’re so inclined, so you can tip the pros for their services.

2. Review Your Disclosures

Reviewing your disclosures before closing is a good idea as well. In your initial listing and sale, you likely stipulated specific details about your home. For instance, you may have detailed which implements and appliances, like garden hoses and refrigerators, would stay with the house and which you would take with you.

On your closing date, review this list and check that you’ve abided by your initial agreement. The other parties will be reviewing the list as well, and you don’t want to shortchange them by taking items you agreed to leave.

3. Clean Your Home

Should a seller clean the house before closing? Though it’s not legally part of the transaction, it’s a considerate thing to do. Just as you’ll want your new home to be clean and shiny once you’re ready to move in, you should also leave your old home pristine for the new owner.

When you’re cleaning, remember to check tasks like these off your list:

- Removing posters and artwork

- Spackling nail holes

- Sweeping

- Mopping

- Dusting

- Wiping down countertops and baseboards

- Scouring bathrooms

- Scrubbing mirrors

- Cleaning windows, inside and out

- Tidying the garage

- Mowing lawns

- Hauling away trash

At the end of a long, mentally exhausting selling process, a long list of cleaning duties may seem daunting. Remember, though, that when you close on your new house, you’ll be grateful that another kind soul performed these same tasks for you.

4. Leave a Blank Canvas

Cleaning and readying your home for the new owner also involves emptying your home of extraneous items — unless you agreed in your disclosures that you would leave them.

That broken bathroom shelf you don’t want to make time to haul to the dump? Find a way to dispose of it somehow. The old lawnmower that technically still runs but you haven’t used in years? Though it’s easy to convince yourself the new homeowner might get some use out of it, it’s generally considerate to dispose of it and let the new owners fill the house as they please.

You also don’t want to leave the new owner with any repair headaches to deal with. In your initial agreements, you likely hammered out the specifics of any repairs and painting you would complete before closing. Be sure to check those tasks off your list, so you can leave the new owners a spruced-up and move-in-ready house.

5. Handle Utility Cancellations

If you haven’t done so already, cancel the utilities for your home on your closing day. Remember to include the following services, as applicable:

- Electricity

- Gas

- Internet

- Recycling

- Sewer

- Trash

- Water

As a courtesy, you may want to arrange to have your utilities canceled after closing so the new owner has a grace period to set up new accounts. And if you cancel your trash pickup before you’ve finished cleaning, be sure to remove all extra trash from the property yourself before closing.

Final Steps to the Closing Process

On closing day, after you’ve completed all the tasks above, you’ll finally be ready to take the last steps in selling your home.

1. Sign Legal Documents

On closing day, you and the buyer will sign various legal documents. You may need to sign a settlement statement, the deed and transfer documents and any other legal paperwork required to complete the sale.

The amount of paperwork you’ll need to go through at closing can seem daunting — 50 to 100 pages of paperwork is not uncommon. Faced with that much reading material, you may feel tempted to skim over the denser sections. We strongly advise you to resist this impulse. If there are any mistakes in your paperwork, you’ll need to get them ironed out before you sign, so they don’t cause you difficulties afterward.

You won’t be alone in going through your paperwork and signing the obligatory legal documents. Your real estate agent will be there to help you navigate the legal jargon and talk you through any thorny points you encounter.

Many people wonder how long it takes to close on a house once the day finally arrives. Because there’s generally so much paperwork to get through, you probably won’t be able to complete closing in a tight window — on your lunch break from work, for instance. It could take a couple of hours in some cases. However, if you choose to work with Assurance Financial our digital E-Closing experience allows you to sign most of your documents before you get to the closing table, significantly cutting down time the day of closing.

2. Pay Closing Costs

Once you and your buyer have completed all the signing, you will pay costs. These are any costs you owe to third parties for expenses related to your home’s sale. The appraisal fee, attorney fees and other outstanding bills are likely to form part of the closing fees.

How much can you expect to pay in closing fees once you reach that point? On average, total closing fees add up to about 2 to 7% of the home’s value. However, as the seller, you’ll likely be paying lower closing costs than the buyer will. Buyers often pay about 3 to 4% of the home’s value in closing costs, while sellers pay between 1 and 3%. While both sides must pay fees to people like their lawyers and real estate agents, the buyer incurs additional costs like inspection and appraisal charges.

Additionally, one of the parties sometimes offers to pay closing costs for the other. During negotiations, to obtain an otherwise more favorable deal, you may have agreed to pay the buyer’s closing costs, or the buyer may have consented to pay yours. In some cases, you may not need to pay any closing fees. Or, you may be responsible for both sets of fees if that’s the deal you agreed to in advance.

3. Remove Remaining Loans

If you still have a mortgage on your home, you’ll have it removed once you’ve completed all payments and deposits. Generally, the title insurance company pays off your mortgage lender and any other lienholders you may have.

4. Transfer the Title

After closing, you’ll also hand over the title to your property and the keys to your home. If you and the buyer have a joint closing, the buyer can take those items right then. If you’re closing separately, you can give the title and keys to one of the agents present.

5. Receive Your Sales Proceeds

You may not receive your sales proceeds on your closing day. You may get them a few days later, or you may have to wait for the relevant financial institutions to sort out the transactions. If your proceeds come in on closing day, you’ll be that much further on your way to whatever comes next.

What Should You Bring?

On closing day, bring the following items to your appointment.

1. Necessary Documents

At the closing, you may meet with your real estate agent, mortgage loan officer and a representative from the title company. You’ll need to bring along any outstanding paperwork.

The most critical piece of paperwork to bring to closing is your home’s title. The title is the document through which you’ll transfer your home’s ownership from you to the buyer.

2. Photo Identification

You’ll also need to bring a valid photo ID like a passport or driver’s license to closing to verify your identity. Because selling a home involves such monumental transactions, this requirement helps protect you from fraud.

3. Payment

Even though you’re selling rather than buying, you’ll still have closing costs to pay. If these costs are substantial enough, you may need to bring a cashier’s check instead of using a conventional check or credit card. Get with your Realtor and lender on the payment amount.

4. Keys

It’s easy to get so caught up in paperwork that you forget to bring your keys to closing. Be sure to bring them, though — that way, you can hand them over and finalize the transaction.

5. A Lawyer

Though you don’t necessarily need to bring a lawyer to your closing, you can if you want to. You may choose to have a lawyer present if you’d like additional assistance in going over the documents and navigating the day’s proceedings. You might also call in your lawyer if the terms of the sale are particularly complicated.

Frequently Asked Questions About Closing on a Home

Below are a few other common questions about closing on a home as the seller.

1. What Is Closing Day?

Closing day is the day you fulfill your sales contract and formally transfer ownership of your house to the new buyer. At the end of this process, though, you’ll be well on your way toward the next stage of your homeownership journey — getting ready to buy or move into a new home.

2. How Do You Determine When Closing Day Will Be?

Generally, you’ll know several weeks in advance when your closing day will be. During the sale’s contract negotiation phase, you and the buyer will set a mutually agreeable closing date. This date will then appear on the purchase agreement contract after you accept the offer. It will become the date by which you strive to complete all intermediate tasks like appraisal, inspection and walk-through if the buyer chooses to proceed with them.

3. Where Does Closing Take Place?

Closing usually takes place at the offices of the escrowee, or the entity that holds your funds before the transaction. Usually, though not always, the escrowee is the title insurance company, the entity that secures your legal ownership of your home.

4. Who Will Be Present at the Closing?

Generally, you can expect some or all of these agents to be present at the closing:

- A title company representative

- The mortgage lender

- Your real estate agent

- The buyer’s real estate agent

- The closing or escrow agent

- Your attorney, or the buyer’s attorney, if either or both or you choose to bring one

As the seller, though, you don’t necessarily need to be present at the buyer’s closing as long as you sign the deed and transfer documents ahead of time. Some sellers choose to be present to discuss any relevant details about the house. To minimize scheduling conflicts and avoid intruding on discussions of the buyer’s finances, many sellers opt for separate closings.

5. How Long Will You Wait Between Accepting an Offer and Closing?

You’ll likely wait several weeks between accepting an offer and officially closing the sale. In 2018, for instance, the average wait between the sale and closing was 43 days.

The delay occurs for a good reason — it protects you and the buyer by giving you time to hammer out logistics, ensure the necessary financial frameworks are in place and make sure the house is in good repair. The extended timeline also benefits the lenders and title brokers involved in the sale — they need time to get the paperwork together and make the deal legally sound.

Be aware, though, that delays are common in the period between the sale and the closing. According to the National Association of Realtors, a third of all home sales meet with delays that defer the closing date. About 46% of those delays arise because of financing issues. Appraisal and inspection concerns account for many of the other postponements.

6. What Can You Expect in the Final Week Before Closing?

Many homeowners wonder what to expect one week before closing. The sheer number of tasks to accomplish in the run-up can lead to uncertainty, and knowing what will likely happen in the final days helps you feel more prepared and confident.

As a general rule, in the week leading up to closing, it’s smart to create a closing checklist. You can write the list down, print it out or merely keep it readily accessible on your phone. Using a list to keep track of what you need to do before closing helps you make sure you remember everything amid the stress and excitement of getting ready.

Below are a few specific activities you can expect to take place before closing.

- Inspection: At some point in the escrow period, the buyer will likely have had a professional complete a home inspection. The inspector will have notified you and the buyer of any significant structural or safety issues and what you need to do to address them. If the buyer chooses to have an inspection and has not yet arranged it, you’ll need to prepare for that to occur in the final week before closing.

- Appraisal: You’ll also need to prepare to receive a professional appraiser at your home. This appointment will likely be separate from the inspection. The appraisal benefits you indirectly because it allows the buyer to receive the funds to purchase your house.

- Walk-through: In the final days before closing, you should prepare for the buyer to perform a final walk-through. The final walk-through is the buyer’s last chance to ensure that the house is structurally sound and its condition hasn’t changed since the buyer last saw it. During the walk-through, the buyer may inspect everything, including major appliances, doors, windows and light fixtures. The buyer will probably also have the original contract in hand and will want to confirm that the home’s original agreed-upon condition matches its actual status. The buyer will want your home to be empty or nearly empty, so you should prepare for the possibility that the walk-through will take place as late as the closing day itself.

- Packing and cleaning needs: As we’ve discussed above, you’ll want to get a head start on packing, cleaning and arranging moving logistics in the days before your official closing. Leaving yourself some breathing room provides some cushion in case of an emergency.

- Closing disclosures: The law requires you and the buyer to receive a document titled Closing Disclosures at least three days before the official closing date. You will receive these documents from your real estate agent. The Closing Disclosures list all the sale’s final terms and describe in detail who pays which closing costs. Double-check the details and make sure the terms are what you’d expected. If not, contact your real estate agent right away to find out why.

In general, keeping in touch with your team throughout the final week before closing is an excellent idea. By touching base with your real estate agent, mortgage officer, title insurance agent and any other relevant professionals, you can ensure your documents are in order and you’ve completed all requirements. The more thoroughly you prepare, the more peace of mind you’ll have that you won’t meet with any surprises on closing day.

It’s a Good Time to Contact Assurance Financial to Apply for a Mortgage

Now that you know what to expect on closing day on a house, you’ll be able to get ready for your closing and whatever new adventures come next.

And when it’s time to purchase another home, let Assurance Financial help you with your mortgage application. We make it easy to apply for a mortgage and estimate costs simultaneously, and our licensed loan officers have the knowledge and experience to get you attractive, custom competitive rates. You can get prequalified in 15 minutes and apply for a wide range of loans, from conventional loans to VA loans to FHA loans, among many others.

Apply for a loan online, or contact us to learn more about getting started with a mortgage.

Sources:

- https://www.realtor.com/advice/buy/reduce-closing-costs/

- https://static.elliemae.com/pdf/origination-insight-reports/Ellie_Mae_OIR_MAY2018.pdf(4)

- https://magazine.realtor/daily-news/2016/01/21/one-third-deals-face-closing-delays

- https://assurancemortgage.com/purchase-your-home/

- https://assurancemortgage.com/apply/

- https://assurancemortgage.com/contact-us/

Purchasing a home is one of the largest investments you’ll make. As such, you probably want to do what you can to ensure your home is as up-to-date and comfortable as possible. However, it can be challenging to save up enough to complete home repairs and renovations. If you’ve found yourself in this situation or another situation where you need a large amount of cash, the answer may be a cash-out refinance.

With cash-out refinancing, you can accomplish your financial goals without relying on a second mortgage, personal loan or credit cards. A cash-out refinance can allow you to borrow from the equity you’ve built in your home and receive cash that can be used for just about anything like paying off high-interest debt, student loan debt or home renovations. At Assurance Financial, we have developed these cash-out refinance guidelines to help you determine if this is the right option for you.

Topics Covered

- What Is a Cash-Out Refinance?

- Uses for a Cash-Out Refinance

- How Much Cash You Can Get With a Refinance

- Benefits of Cash-Out Refinancing

- Things to Consider With a Cash-Out Refinance

- How a Cash-Out Refinance Works

- Cash-Out Refinance FAQ

What Is a Cash-Out Refinance?

While your mortgage matures, you continually gain equity in your property. Your home’s equity is the amount of your home’s value that you have already paid off. Gaining equity can happen in two ways:

- Your mortgage principal decreases as you pay your monthly payments. Each time you make a mortgage payment, you gain equity in your home.

- The value of your home increases.

To use cash-out refinancing, you must have equity built up. With a cash-out refinance, you can take advantage of your home’s equity and use the cash in exchange for a larger mortgage. When you decide to pursue cash-out refinancing, you’ll borrow more than what you owe on your current mortgage and receive the difference in cash.

Unlike taking out a second mortgage, when you decide on a cash-out refinance, you won’t be adding another payment to your monthly bills. With a cash-out refinance, you’ll pay your old mortgage, and it’ll be replaced with a new mortgage.

For instance, if you purchase a home for $300,000 and you pay off $100,000, you still owe $200,000 on your home. However, you want to make $30,000 worth of renovations. With cash-out refinancing, you’ll take a portion of your home’s equity and add what you take out of the equity to your new mortgage’s principal. As a result, your new mortgage will be worth $230,000 – the $200,000 you owe plus the $30,000 for the renovations. After closing on the loan, you will receive the $30,000 in cash from your lender.

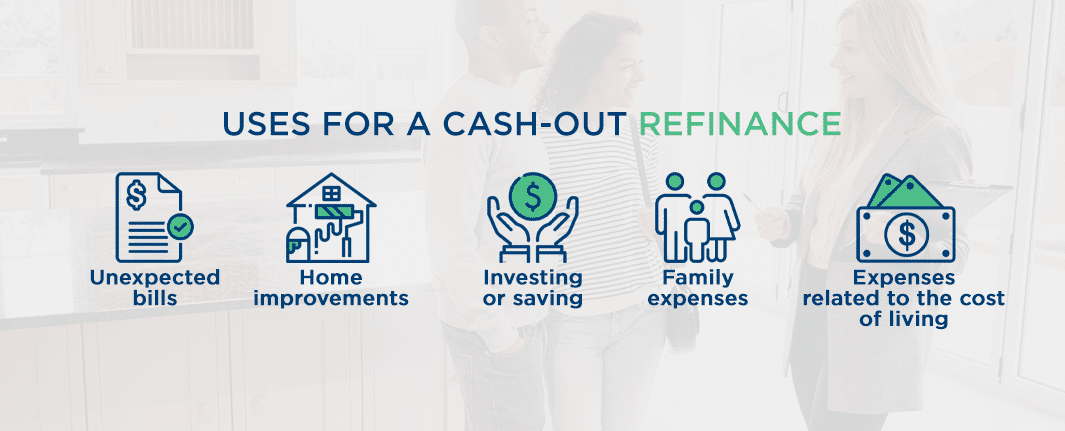

Uses for a Cash-Out Refinance

With cash-out refinancing, you can use the money from your home’s equity for anything you want. You can use it to meet various financial needs, such as:

- Unexpected bills: If you get an unexpected car bill or medical bill, you can use your cash-out refinance to cover these unexpected expenses.

- Home improvements: With cash-out refinancing, you can make home repairs and renovations like constructing an addition or building a new roof. By refinancing, you’ll free up cash each month to put toward these improvements.

- Investing or saving: By refinancing, you’ll have more cash in your pocket that can be saved, invested or spent as you choose. If you want to take advantage of the market to build your retirement savings, for example, you can use your home’s equity to invest in your 401(K).

- Family expenses: If you are planning to start a family, your kids are heading to college or you need to support an elderly family member or a relative with medical bills, then you may want to free up some extra cash each month.

- Expenses related to the cost of living: When you purchased your home, you may have had a different cost of living due to a new job, a growing family or more expenses. Refinancing may help make your current financial reality more affordable.

How Much Cash You Can Get With a Refinance

A cash-out refinance also typically gives you access to a lower interest rate monthly than a credit card. Keep in mind that you may not be able to pull out all of your home’s equity, though you can pull out a large percentage. One exception is a VA loan, which allows you to take out the full amount of your home equity.

The amount you can take out generally depends on the value of your home. Before you can find out how much you qualify for in a cash-out refinance, your home may need to be appraised. The percentage you can take out depends on your circumstances and varies from lender to lender. Some lenders may allow you to take out all of your home equity depending on your credit score, for example, but others may not.

With cash-out refinancing, you’ll be withdrawing some of your home equity in one lump sum. After you complete a cash-out refinance, you also may pay more in interest since you’re increasing the amount of your loan.

Benefits of Cash-Out Refinancing

Homeowners choose a cash-out refinance for many reasons. If you determine that cash-out refinancing is the right option for you, you can enjoy the following benefits:

1. Renovations and Home Improvements

From a broken HVAC system to a leaky roof, upgrades are often needed at some point during homeownership. With cash-out refinancing, you can use the equity in your home to fund the renovations and home improvements needed. Whatever improvements you decide on, you may want to choose safe projects that future buyers will value.

2. Increased Credit Score

By using the cash from this type of refinancing, you may be able to increase your credit score. This is because a cash-out refinance can reduce your credit utilization, as you will now have a greater amount of credit available to you. Additionally, you can use your cash to pay off debt, further improving your credit utilization and positively impacting your credit score.

3. Debt Consolidation

Cash-out refinancing can provide you with the money needed to pay off outstanding debts. You can also transfer debts to a lower-interest payment. When you choose cash-out refinancing to pay off your high-interest credit cards, this can save you thousands in interest. Tapping the equity in your home may be less expensive than other forms of financing, such as credit cards or personal loans.

4. Lower Interest Rates

Getting a lower interest rate is one of the most common reasons homeowners choose to refinance. If you originally purchased your property when mortgage rates were higher, a cash out-refinance may offer you a lower interest rate.

Additionally, if you are suddenly hit with an unexpected bill, you may have to pay a higher interest rate, especially if you pay the bill with a home equity line of credit or a credit card. Credit cards typically have higher interest rates than mortgages. If your home’s equity is enough to cover an unexpected bill, using a cash-out refinance could save you thousands of dollars in interest.

5. Lower Monthly Payments

With cash-out refinancing, you may be able to enjoy lower monthly payments. When you have lower monthly payments, you can put more money toward other financial needs, such as a parent’s medical bills, your child’s college tuition or a special vacation.

Additionally, if something like your child’s student loan rate is higher than the rate for your new mortgage, then tapping your home’s equity to help pay for your child’s college education may be a smart financial move.

6. Tax Deductions

Additionally, you may be able to deduct your mortgage interest from your taxes with a cash-out refinance if you use the cash to purchase, build or significantly improve your home. Eligible projects for tax deductions may include:

- Installation of a home security system.

- Construction of a fence around your home.

- Replacement of windows with storm windows.

- Construction of a new bathroom or bedroom.

- Addition of a central heating or air conditioning system.

- Addition of a hot tub or swimming pool in your backyard.

- Improvements to your roof that allow it to more effectively protect you and your belongings from the elements.

Home improvements should make your home more accessible or add value to it to qualify for tax deductions.

Things to Consider With a Cash-Out Refinance

Before you commit to cash-out refinancing, there are a few considerations to be made. The following are various aspects of a cash-out refinance for you to consider if you are interested in this option:

Leaving Equity in Your Home

Depending on your loan, you may need to leave a certain percentage of equity in your home. Conventional loans and FHA loans both require homeowners to leave some equity in their homes after cash-out refinancing. The only exception is for a VA loan for which you are not required to leave any equity following a cash-out refinance.

Cash Isn’t Immediately Accessible

As when you purchase a home, you may need to submit to appraisal and underwriting processes before the lender can approve your cash-out refinance. Even after closing, you have a few days to cancel the loan. You also won’t receive your cash immediately after closing. Instead, it will take a few days after closing before you receive your cash, so if you need money immediately, then cash-out refinancing may not be the best option for you.

At Assurance Financial, you can cancel your cash-out refinance for no cost within three days after closing. After these three days, your new loan will be funded, and your previous loan will be paid.

Closing Costs

Similarly to purchasing a home, you will pay closing costs if you refinance. Common closing costs include:

- Appraisal fees

- Lender origination fees

- Credit report fees

- Attorney fees

If you only need a small loan, review whether the closing costs may negate what you will be saving with a lower interest rate.

To avoid paying closing costs upfront, you may be able to roll them into your new mortgage. However, in this case, you may pay a higher interest rate. If you take out another 30-year mortgage or you refinance at a higher interest rate, you may pay more interest in total. Shop multiple lenders to make sure you are getting the most competitive terms and rates.

Changing Loan Terms

With cash-out refinancing, you will pay your original mortgage and then replace it with a new mortgage. As a result, since your new mortgage may take you a longer amount of time to pay off, your interest rate may change, and your monthly payment may be adjusted.

For example, if you have an adjustable-rate mortgage (ARM), you may want to replace it with a fixed-rate mortgage. Alternatively, you may want to switch to an ARM if you began with a fixed-rate mortgage. Whatever you choose, make sure you review your lender’s Closing Disclosure and analyze the new loan terms.

How a Cash-Out Refinance Works

The steps involved in the cash-out refinancing process are similar to the steps of purchasing a home. After determining that you meet the requirements for a cash-out refinance, you select a lender, submit your application, get approval and receive your check.

How to Qualify for a Cash-Out Refinance

Since lenders take on more risk with cash-out refinancing, it can be a bit harder to qualify. However, every lender sets their own requirements for determining which homeowners qualify for a cash-out refinance. The following are some of the common requirements for a cash-out refinance:

- Equity in your home: If you want to pursue a cash-out refinance, you need to have equity in your home. Unless you are eligible for a VA refinance or another exception, you may not be able to cash out all of your home equity, so you may want to carefully review your current equity before committing to a refinance and ensure you can convert enough to meet your goals.

- High or improved credit score: For a cash-out refinance, you typically need a score of at least 600. If you have a high credit score, you’re more likely to qualify for a cash-out refinance and more likely to get a lower interest rate.

- Low credit utilization: If you are concerned about your credit score, you may want to review your credit utilization. Generally, it is recommended to keep your credit utilization below 30%. This means you use less than 30% of your total credit limit. If you have a credit limit of $3,000, this means spending less than $900.

- Low debt-to-income ratio: Your debt-to-income (DTI) ratio refers to the total amount of your monthly payments and debts divided by your monthly income. If you pay a total of $2,000 per month in bills, for instance, and your total income per month is $5,000, your debt-to-income ratio is $2,000 divided by $5,000, which is 40%. Keeping your DTI ratio as low as possible can make you more likely to qualify for a cash-out refinance.

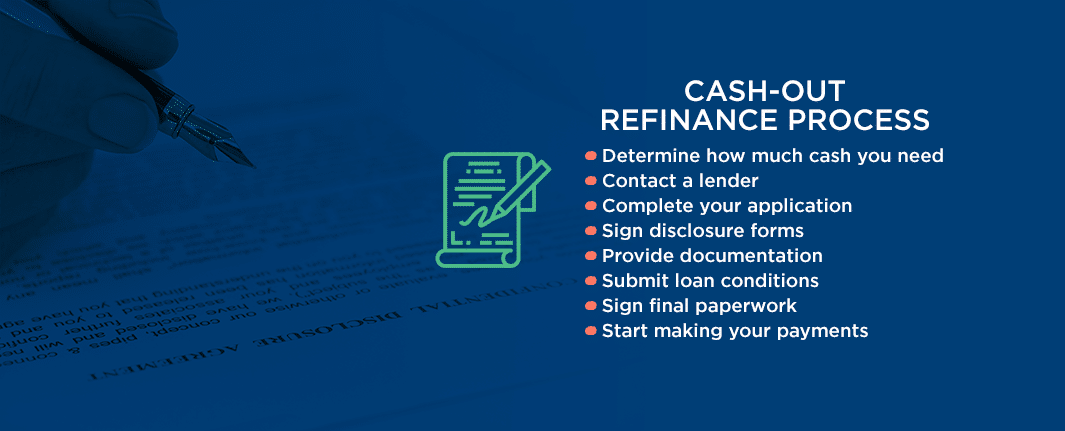

Cash-Out Refinance Process

The following are the steps in the cash-out refinancing process:

- Determine how much cash you need: After you determine that you meet the requirements to qualify for cash-out refinancing, you may want to do some math to determine how much you need for your goals. If you want to perform renovations or repairs, for example, you may want to get estimates from contractors. If you plan on consolidating your debt, you may want to review your bank and credit card statements to determine how much cash you’ll need to pay your debts.

- Contact a lender: At Assurance Financial, we strive to make your refinancing process as fast and painless as possible. You can get pre-qualified in as little as 15 minutes and receive a no-obligation quote. We offer every type of mortgage loan available, and we can provide you with a credit check and a rate quote for free.

- Complete your application: When you’re ready to pursue a cash-out refinance, you can start your application with us by speaking with one of our loan officers.

- Sign disclosure forms: At Assurance Financial, we will send your initial disclosures to sign. You can also use this opportunity to ensure you’re achieving your goal and to verify your loan terms.

- Provide documentation: After you sign your disclosures, you will provide your documentation, such as income and asset verification.

- Submit loan conditions: Next, we will send your paperwork to an in-house underwriter who will inform us about any additional items that are needed.

- Sign final paperwork: After you are approved for your cash-out refinance, you will sign your final paperwork with a notary.

- Start making your payments: At this point, the refinancing process is complete. After the funding process, you’ll start making payments in 30 to 60 days on your new mortgage.

Getting Approved for a Cash-Out Refinance

After applying for cash-out refinancing, you will receive the decision from your lender about whether you have been approved for the refinance. Your lender may request financial documents, such as W-2s, pay stubs or bank statements as proof of your debt-to-income ratio. After you are approved, your lender will guide you through the next steps.

Cash-Out Refinance FAQ

Do you have additional questions or concerns about cash-out refinancing? The following are a few of the most frequently asked questions we receive about cash-out refinancing:

1. Can I refinance and roll auto loans into my mortgage?

Yes, any debt can be paid off with cash out of your home. You cannot necessarily “roll” the debt, but you will get an account, like a checkbook, and you can make it payable to anything you want.

2. If I have a home equity loan, can I consolidate that into my mortgage if I refinance? What about with HELOC?

Yes, a lot of homeowners choose to do this, and some choose to open another equity line.

3. Can I consolidate student loans into a mortgage?

Yes, you can consolidate your student loans into your mortgage. This is also referred to as debt reshuffling, and it can be particularly attractive to those who have sufficient home equity.

4. Do I need to pay taxes on a cash-out refinance?

Since the cash you take out through a cash-out refinance is a loan, it is not considered income by the IRS. As a result, you don’t need to report it when filing your taxes, though you may get a beneficial tax deduction if you do report it. To better understand your options, speak with a tax professional.

Learn More About Cash-Out Refinancing From Assurance Financial

Are you ready to refinance? At Assurance Financial, we have been servicing loans to customers since 2001. When you choose to work with us, you can speak with one of our loan officers. Our loan officers are available across multiple states, and they have the expertise and knowledge needed to guide your cash-out refinancing and find the best deal available to you.

We will aim to find you a competitive rate or a deal that lets you draw on your equity. Contact us at Assurance Financial to learn more about cash-out refi requirements or apply for a new loan today.

Sources

- https://assurancemortgage.com/four-signs-you-should-refinance-your-mortgage/

- https://assurancemortgage.com/about-us/

- https://assurancemortgage.com/find-a-loan-officer/

- https://assurancemortgage.com/contact-us/

- https://assurancemortgage.com/apply/

Between 2015 and 2019, there was an average of 13.8 natural disasters per year. Natural disasters can range from hurricanes to hail storms and wildfires to tornadoes. They might be unavoidable, but with a bit of planning and preparation, you can reduce severe weather damage and its effects on your home and family.

The first step to take toward emergency preparedness is to recognize and understand the types of hazards and disasters your home and family are likely to face. From there, you can focus on creating a disaster preparedness plan that outlines what to do and where to go if a storm or other natural disaster is headed your way.

You can download our full disaster prep guide here.

Topics Covered:

- Steps to Creating a Disaster Preparedness Plan

- What to Do After a Disaster Occurs

1. Identify Hazards

Some types of natural disasters are more likely to occur in certain parts of the U.S. than others. It’s important to plan for the type of hazards your household could potentially experience based on your location. A few possible hazards to include in your planning are:

- Earthquakes: Earthquakes can happen across the U.S., but they are much more common along the West Coast in Hawaii, Alaska and along the Mississippi River Valley. When an earthquake occurs, the ground shakes suddenly as rocks beneath the surface shift. Preparing your home for an earthquake often involves securing loose objects and furniture. During an earthquake, it’s important to know where to go for cover and protection.

- Floods: Flooding occurs when water rises and covers dry land. A flood can happen anywhere and can range from mild to severe in terms of damage. They can occur as a result of rain and storms or as a result of an overflow of water from a dam or storm system. Floods are one of the most common natural disasters in the U.S.

- Hurricanes: Hurricanes occur along all coasts of the U.S. The effects of hurricanes can also be felt further inland. They bring with them heavy rains, strong winds and the potential for flooding. Depending on the severity of a hurricane, your preparedness plan might involve leaving your home and moving out of the path of the hurricane, or you might shelter in place until the storm is over.

- Snowstorms and extreme winter weather: Heavy snow, ice, high winds, freezing rain and excessively cold temperatures can all be part of extreme winter weather. Although extreme winter weather is more common in the Northern and Midwestern parts of the U.S., some warmer parts of the country have also experienced out-of-the-ordinary snowstorms. Preparing for snowstorms and winter weather can involve prepping your home to protect it against freezing temperatures, stocking up on supplies and knowing what to do to keep your family warm and safe throughout the storm.

- Tornadoes: Although tornadoes most commonly occur in the Southeastern and Midwestern parts of the U.S., they can develop anywhere across the country. Tornadoes can bring with them wind speeds above 200 mph. They can pick up cars and destroy buildings. Preparing for a tornado means knowing where to go in your home to seek shelter and learning how to recognize the signs that a funnel cloud is on its way.

- Wildfires: Wildfires are unplanned and often burn through natural areas such as forests, prairies and grasslands. If not quickly controlled, they can spread to surrounding communities and cause damage to houses and other buildings. If you live in an area that experiences wildfires, it’s vital that you have a home evacuation plan and emergency response plan. You can also take steps to protect your home from fire damage before a wildfire occurs.

In addition to the more common hazards above, you might need to make a plan to prepare for a volcanic eruption if you live in an area with active volcanos or a plan for a tsunami if you live in a coastal area.

2. Create a Preparedness Plan

Everyone in your household should be on the same page when it comes to emergency situations and how you’ll handle them. Part of the process of developing an emergency response plan should include holding a family or household meeting. During the family meeting, focus on creating a disaster preparedness plan.

Who attends the meeting and who is responsible for what in the event of an emergency largely depends on who is in your household and their ages. You can explain the basics of natural disasters and emergencies to young children, for example, but you most likely won’t expect them to take on responsibilities if a disaster or emergency strikes. As you put together your home evacuation plan, consider the following factors:

The Types of Disasters Likely to Occur in Your Area

Different types of natural disasters and emergency situations require a different response. Research the variety of potential disasters to find out how many typically occur in your region during the year. You should also investigate the risk of one or more of those situations being severe enough to require evacuation or sheltering in place.

How You Can Get Information in the Event of an Emergency

During an emergency, power might go out and the internet might not work. Decide how you’ll stay connected to the outside world. You might invest in a battery-powered radio or a wind-up radio. If your mobile phone still works in an emergency, you may be able to receive emergency alerts on it.

How You’ll Evacuate if Needed

Talk to your household members about how you’ll leave home if needed due to an emergency. Your evacuation plan should include a route to take to get to a safe place and a mode of transportation to get there safely, such as a car. Also, have a destination in mind if you need to leave. Can you go to a family member’s house or the home of a friend? If not, you might need to learn the location of the nearest emergency evacuation shelter.

Where You’ll Meet if You Need to Leave and Get Separated

It might be the case that you and your household members have to split up when you get an evacuation order. To be on the safe side, have a plan for where you’ll meet up if you get separated.

How You’ll Communicate With One Another

Along with knowing where to find your household members in the event of an emergency, make a plan for staying in touch during a natural disaster. Make sure everyone in your household has each other’s phone numbers stored in their cellphones and written down on a piece of paper.

It’s also a good idea to have the contact information for your family doctor, your children’s schools, your work and your children’s caregiver written down on a piece of paper that members of your household have with them at all times. Also, include the contact information of a relative or friend who lives in another town. That person can serve as the central contact point if you and your family need to evacuate and lose contact with each other.

What You’ll Do About Household Pets

If you have pets in your home, you want to protect them in the event of an emergency. Include your pets in your plan by deciding who will put them in their crates or carriers and transport them to the car when you’re evacuating. You might want to make a sign and put it by your front door letting emergency responders know there are pets in the house who may need to be rescued.

The Safe Spot in Your Home

While some situations will require you to leave your home, not all of them will. Determine an ideal location in your home to seek shelter during an emergency event. For example, in the event of a tornado, a small room without windows on the lowest floor of your home is usually the best place to seek shelter.

3. Gather Supplies and Prepare

Stock up on supplies to keep your family fed, hydrated, comfortable and warm in the event of an emergency. The Centers for Disease Control and Prevention (CDC) recommend having a three-day supply of food on hand in case you are unable to leave your home or in case of supply chain disruption. The foods you keep on hand should:

- Not require refrigeration or cooking.

- Have a long shelf life.

- Be low in salt.

- Be appropriate for babies and any adults who follow a special diet.

You may need to swap out the foods in your disaster preparation kit from time to time, as they approach their expiration or “best by” date. Keep an inventory of your emergency food stash that also includes the expiration dates of the products. As the dates approach, consume the food to keep it from going to waste, then replace it with new products.

Along with food, the CDC also recommends having an adequate amount of water on hand for each person in your home, in case a disaster affects the plumbing. Have at least one gallon of water per person and pet in your home per day. If you live in an area with a hot climate, or if people in your home are ill or pregnant, you might want to have more than one gallon per person. The CDC recommends having at least three days of water on hand, if not two weeks’ worth of water.

Food and water aren’t the only things to stock up on and include in your emergency preparation kit. You should also have a first-aid kit and an adequate amount of medication. Make sure you have enough prescription medication on hand in case of an emergency, as well as a supply of over-the-counter medicines, such as pain relievers and cold medicine. You’ll also want to have a thermometer.

First-aid supplies to include in your disaster preparedness kit include:

- Bandages

- Antibacterial ointments

- Antibacterial wipes

- Burn creams

- Tweezers

- Scissors

- Vinyl or another type of non-latex gloves

Your kit should also include any items your family or household members need, such as contact lenses and cleaning solution, asthma inhalers and diabetic testing strips. Don’t forget about comfort and warmth when stocking your kit. Include blankets and sweaters for each member of the family, in case you lose power or the heating goes out as a result of a storm.

It can also be worthwhile to learn certain skills to complement your kit, such as first-aid skills. If possible, take a CPR certification course and a first-aid course. Also, become familiar with your home and the location of shut-off valves in case you need to turn the water or electricity off during a disaster. Make sure others in the home know the locations of shut-off valves, too.

4. Practice Your Plan

Practice makes perfect, including a family emergency plan. Doing test runs or drills of your plan can help you smooth out any wrinkles or find solutions to any problems that come up before a real emergency occurs.

It’s a good idea to practice both a shelter-in-place plan and an evacuation plan so you can see how your household members respond in each type of situation. When you practice your plan, try to complicate the situation. For example, you might practice what you would do if you and your spouse became separated just before you had to evacuate, or if you have to evacuate from your home while your spouse is at the supermarket or their workplace.

Since situations can change from year to year, practicing your plan once or twice a year allows you to make adjustments as needed. During the COVID-19 pandemic, your evacuation plan should include a plan for protecting your household members from the virus, particularly if you end up having to go to a public shelter.

Along with performing dry runs of your emergency plan, make an effort to keep track of your supplies. Rotate out older foods and water every few months, replacing them with new items. Test the items in your kit, such as the radio and thermometer, to make sure they still work and that the batteries are fresh. If contact information for anyone in your family changes or if your emergency contact changes, make sure to keep that information up to date.

5. Protect Your Home and Family

In addition to having a plan in place in the event of an emergency, there are steps you can take to protect your family and house from the damage caused by an event such as a hurricane, tornado or winter storm:

- Install the right equipment: Some home features, such as a sump pump, can help reduce the damage caused by flooding and strong storms. It’s also a good idea to have alarm systems installed at home, such as smoke alarms and carbon monoxide detectors, to alert you to any potential hazards.

- Keep the area around your home clutter free: Outdoor furniture, toys, grills and gardening equipment can blow around during a storm with strong winds, causing damage to your house or other structures. If possible, limit the number of items you store outside. If you do have outdoor furniture or other gear, find a way to secure it before a storm comes. You can tie it down or store it in a garage or shed.

- Care for trees and shrubs: Prune trees and shrubs to reduce the chance of branches breaking away and falling off during a storm or other disaster.

- Clean your gutters: If leaves and other debris collect in the gutter around your roof, water damage can occur. The damage can be severe after a snowfall or during a storm with excessive rain. Cleaning the gutters at least once a year can help reduce water damage to your roof.

- Barricade your windows: Hurricane-strength winds can easily shatter windows. Tornados can also break windows. Covering up the windows of your home with plywood or shutters before a storm strikes can help keep the home in one piece and can protect the people inside the house.

- Maintain your home’s systems: Keeping your home’s systems in good working order means they will be more likely to keep functioning in an emergency. Have your heating system maintained each year to make it more likely to keep working during a blizzard or other winter storm. If you live in an area that experiences frequent, long-lasting power outages, installing a backup generator can be a smart move. The generator can kick on when the main power goes out, keeping you and your family warm and comfortable in the midst of a storm.

- Purchase the right amount of insurance: Depending on your location and the risk level for certain types of disasters, you might need to purchase special homeowners insurance to keep your home adequately protected. If you live in an area with a lot of flooding, you’ll need flood insurance in addition to your basic policy. Talk to your insurance agent to make sure you have the right amount of insurance for your property.

You can download our full disaster prep guide here.

What to Do After a Disaster Occurs

What you do after a disaster largely depends on whether you had to evacuate your home or not. If you did have to leave your home, it’s best to wait until local officials give you the all-clear that it is safe to return. When you get to your home, proceed with caution. You might want to inspect the outside of the house first, walking around the perimeter to assess any damage.

Be sure to give your insurance company a call, as someone from their team will need to come out and evaluate the damage before you can file a claim. If you are concerned that the event caused structural damage to your property, you may want to call a structural engineer to evaluate the condition of the building before you go inside.

When you do go back into your home, keep an eye out for the following:

- Cracks in the walls, ceiling and along the foundation

- Damage to water pipes

- A rotten egg smell, which is the sign of a gas leak

- The state of the electrical system — if possible, turn the electricity off

- Standing water in your basement — avoid going into a basement with standing water and arrange to have it pumped out

Now is also the time to reconnect with loved ones who were in the area or any family members you might have been separated from. If you have young children, check in with them to see how they are coping with the situation. Some children might show signs of distress immediately after a disaster or emergency, while others might seem calm at first but have concerns later on. You might consider scheduling therapy for your children or yourself and arrange for everyone in your family to see a doctor after an emergency situation.

Apply for a Mortgage With Assurance Financial Today

Your home is likely one of the biggest investments you’ll make, which is why it’s vital to have a plan to protect it and the important people who live in it if a disaster strikes.

If you’re in the process of searching for a home, whether you’re a first-time buyer or are looking to upgrade, the first step is to see if you qualify for a mortgage. Our easy online mortgage application and helpful Loan Officers make the process a breeze. You can get pre-qualified for a home loan in 15 minutes! Get started today.

Sources

- https://coast.noaa.gov/states/fast-facts/weather-disasters.html

- https://www.ready.gov/earthquakes

- https://www.ready.gov/floods

- https://www.ready.gov/hurricanes

- https://www.ready.gov/winter-weather

- https://www.ready.gov/tornadoes

- https://www.ready.gov/wildfires

- https://www.ready.gov/tsunamis

- https://www.ready.gov/volcanoes

- https://www.ready.gov/sites/default/files/2020-03/create-your-family-emergency-communication-plan.pdf

- https://www.ready.gov/plan

- https://www.ready.gov/evacuation

- https://www.ready.gov/alerts

- https://www.cdc.gov/disasters/foodwater/prepare.html

- https://www.cdc.gov/prepyourhealth/takeaction/personalneeds/index.htm

- https://www.cdc.gov/prepyourhealth/takeaction/paperwork/index.htm

- https://www.habitat.org/impact/our-work/disaster-response/disaster-preparedness-homeowners/disaster-supply-kit

- https://www.habitat.org/impact/our-work/disaster-response/disaster-preparedness-homeowners/family-evacuation-plan

- https://www.ready.marines.mil/Make-a-Plan/Making-a-Family-Emergency-Plan/

- https://blog.litchfieldbuilders.com/5-ways-can-protect-house-natural-disaster

- https://www.cdc.gov/childrenindisasters/before-during-after.html

- https://www.ready.gov/returning-home

- https://www.unitedway.org/my-smart-money/immediate-needs/ive-experienced-a-natural-disaster/what-to-do-after-a-disaster

- https://assurancemortgage.com/apply/

- https://assurancemortgage.com/first-time-home-buyer-loans/

- https://assurancemortgage.com/experienced-homebuyer/

Temporary setbacks can prevent you from being able to make your mortgage payments for a couple of months. In the wake of unexpected events such as COVID-19, a flood or other natural disasters, many Americans face unemployment, furloughs, illness and the death of family members. This challenging time may heavily impact your finances, and you may be wondering what to do if you can’t pay your mortgage.

While many homeowners may expect that an inability to make a monthly mortgage payment will immediately result in a default on the mortgage loan or foreclosure on their property, the reality is not so cut and dried. Fortunately, another possibility is mortgage forbearance.

What Is Mortgage Forbearance?

Mortgage forbearance refers to an agreement between you and your mortgage servicer to temporarily reduce or suspend your mortgage payments for a specific period. The option of mortgage forbearance can allow you to cope with your short-term financial difficulties by giving you some time to recover after a hardship. In some cases, there is government mortgage relief, and in others, the servicer may offer a special program of mortgage forbearance.

As part of this agreement, you agree to a plan for your mortgage that will bring you up-to-date on your payments over a set time. Essentially, you will need to repay these paused or lowered payments down the road after the temporary hardship has ended.

If you are dealing with a temporary hardship or are behind on your monthly mortgage payments or may soon miss a payment, mortgage forbearance may be an option for you.

Benefits of Mortgage Forbearance

What benefits can mortgage forbearance offer you during a time of temporary hardship? The following are a few of the benefits of mortgage forbearance:

- Suspends or lowers your monthly mortgage payment temporarily

- Allows you to avoid foreclosure or damage to your credit score

- Enables you to remain in your home

- Gives you time to get back on your feet and improve your current financial situation

Mortgage forbearance, then, is essentially pausing your payments. If you have been dealing with hardships due to COVID-19 and you can’t pay the mortgage this month, you may be able to pursue mortgage forbearance.

Frequently Asked Questions About Mortgage Forbearance

Here are a few of the frequently asked questions we receive about mortgage forbearance from homeowners:

- Do I have to repay missed payments? If your mortgage is in forbearance, you must repay your missed payments. Forbearance delays your payments, rather than forgiving them.

- Will interest on my mortgage continue accruing? Yes, interest on your mortgage will likely continue accruing while your mortgage is in forbearance, though this varies by

- Will mortgage forbearance affect my credit? No, opting for mortgage forbearance is unlikely to adversely impact your credit score unless your servicer reports it to a credit bureau. However, you may have trouble getting approved if you try to refinance your mortgage shortly afterward. Also, it’s a good idea to check your credit report each month to quickly resolve any issues that could arise.

- Can I pay my missed payments whenever I want? No, you cannot repay your missed mortgage payments whenever you want. Servicers handle mortgage modifications differently, so you may have to pay all of your missed payments in a lump sum or add them to the end of your loan term.

- Where should I apply for forbearance? You should apply for mortgage forbearance where you currently make monthly payments.

Mortgage forbearance is for homeowners who are dealing with a situation that causes financial hardships. In uncertain times, you may be worried about making your monthly mortgage payments, but before you stress, you should reach out to your servicer to discuss your options.

How Does Mortgage Forbearance Work?

To request mortgage forbearance, you should first contact your servicer. The exact specifics of how mortgage forbearance works depend on a few factors, such as your servicer, the type of mortgage you have, the underlying circumstances and how long you have been making monthly mortgage payments. Most terms for mortgage forbearance fall under one of two agreements.

- Suspended payments: Your servicer will agree to a mortgage pause for a specific period.

- Lowered payments: Your servicer will reduce your monthly mortgage payments, but you’ll need to pay them on the same schedule.

The goal of these agreements is to keep the bank from foreclosing on your home if you’re temporarily incapable of paying your monthly mortgage payments in full.

Mortgage Forbearance Terms

If you are eligible for mortgage forbearance, you and your servicer will discuss the terms, such as:

- The length of time your mortgage forbearance will last

- How you will repay your payments to your servicer after your mortgage forbearance ends

- Your reduced mortgage amount if you need to keep making monthly payments

- Whether your servicer will report your mortgage forbearance to credit bureaus

Speak with your servicer to determine how these terms will affect your monthly payments and total mortgage amount.

How Long Mortgage Forbearance Lasts

The length of the forbearance period depends on the amount of time you and your servicer agree upon, as well as what caused the setback and your likelihood of being able to return to making your full monthly mortgage payments. As such, a mortgage forbearance period may last for a couple of months or up to a year. Since the goal of mortgage forbearance is to provide relief to homeowners with short-term financial difficulties, it usually does not last for more than a year.

Your servicer may also ask you to provide updates during your mortgage forbearance period. If it seems like you’ll need a different type of assistance or an extension on your forbearance, you can speak to them and discuss your options.

Mortgage Forbearance Repayment Options

While your mortgage is in forbearance, your loan will likely continue accruing interest. After your mortgage forbearance period ends, you must repay the reduced or suspended amount. You will repay your servicer according to the forbearance terms you previously arranged.

With a mortgage forbearance, you may be able to choose from the following repayment options.

- Reinstatement: One of your repayment options is a one-time lump sum payment for your reduced or suspended amount.

- Added amount to subsequent mortgage payments: Another option for repayment is adding a specific amount to each of your monthly payments until you have repaid the full forbearance amount.

- Tack on missed payments: Finally, you may also be able to add the amount of your repayment to the end of your loan. Doing so will lengthen the term of your mortgage.

You may also be able to modify your past-due mortgage amount, which will change the terms of your loan so your payments can be more manageable. Modification is an option may be available to you if you do not have the funds to cover a repayment plan or reinstatement or if your financial hardship continues for a longer period than initially anticipated.

To qualify for mortgage forbearance, you may have to pay a higher interest rate on your monthly payments once they resume, or you may have to pay a one-time fee.

How to Apply for Mortgage Forbearance

As soon as you realize you are in danger of missing a mortgage payment, you may want to reach out to your mortgage servicer, which is the company you send your monthly mortgage payments to. If you are unsure who services your mortgage, you can find the company’s contact information on your mortgage statement.

Events like natural disasters may have time limitations related to initiating a mortgage forbearance, so you may want to contact your servicer as soon as possible. When you do so, keep in mind that during unpredictable times, servicers will be dealing with a high call volume and may also be struggling with upheaval.

When you reach out to your servicer, prepare to discuss the following.

- The event that led to the request: You will likely discuss with your servicer what event or circumstances caused you to request mortgage forbearance.

- Length of inconvenience: You may also discuss with your servicer whether you expect the problem to be short- or long-term.

- Actions you have taken: Another point of discussion may be what you have already done to rectify or avoid this situation.

It may be helpful to request that your servicer note your history of on-time payments. Aim to continue making your monthly payments while you are waiting for a decision from your servicer on mortgage forbearance.

While a bank does not have to approve your request for mortgage forbearance, during a time of nationwide difficulty, a servicer may be more inclined to help with your mortgage payments and approve your application so you can keep your home.

Who Qualifies for Mortgage Relief?

How do you know if you are an ideal candidate for mortgage relief programs? Though eligibility requirements for mortgage forbearance depend on the servicer, you will most likely start your request for mortgage forbearance by filling out an application. Depending on the servicer, you may apply online or by calling.

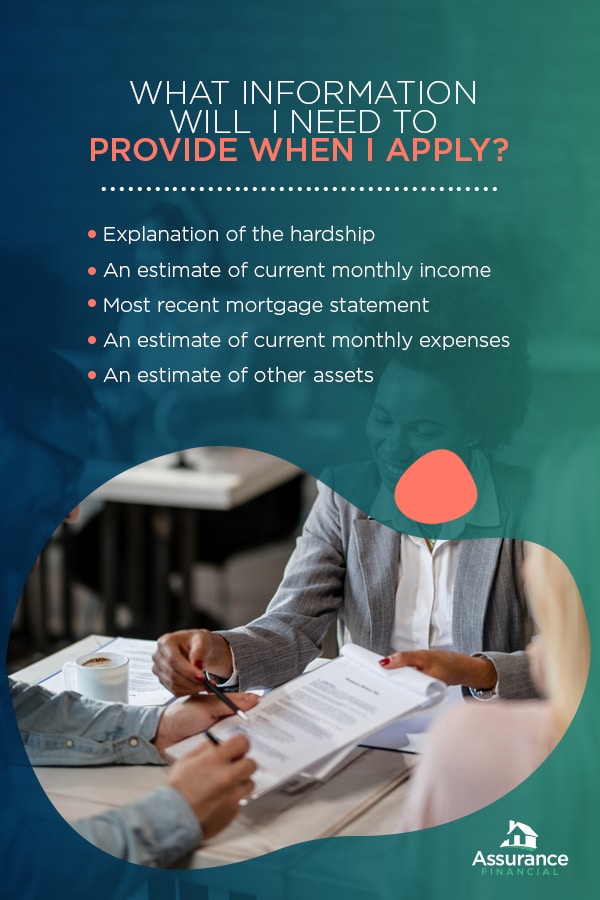

What Information Will I Need to Provide When I Apply?

When you fill out your online application or call your servicer, you may want to have the following information on hand.

- Explanation of the hardship: When you apply online or call your servicer, you may need to explain the hardship you are facing. If possible, you may also need to supply documentation that can substantiate your claim.

- An estimate of current monthly income: You may need to supply an estimate of your monthly income when you apply online or call your servicer. To demonstrate your income, you may need to provide your servicer with your income tax returns and paystubs.

- Most recent mortgage statement: When you call or apply, you may need to provide the most recent statement from your mortgage payments.

- An estimate of current monthly expenses: Along with your monthly income, you may also need to provide your servicer with an estimate of your monthly expenses, which include your monthly debt payments, such as student loans, car loans or credit card payments.

- An estimate of other assets: You may also need to provide your servicer with information about your other assets, such as how much cash you have in the bank.

Keep in mind that to qualify, you may need to put in your request for mortgage forbearance within a specific period after the natural disaster or change in circumstances. For example, your servicer may mandate that you request mortgage payment assistance within a month of filing for unemployment.

What If My Mortgage Forbearance Request Gets Denied?

If your servicer denies your application for mortgage forbearance, you may be able to appeal the decision. When you do so, a different loan officer who was not involved in the original decision will review the application you submitted. After this person goes over your application, you will receive an updated decision.

If you are still facing difficulty in reaching an agreement with your loan servicer, you may be able to find help elsewhere.

- Housing counselors approved by HUD: You may be able to discuss your situation with a housing counselor who has received approval from the U.S. Department of Housing and Urban Development. A housing counselor may discuss your options with you, such as a modified payment program.

- Lawyers: One option you may want to consider is reaching out to an attorney who may be able to provide you with legal resources and assistance.

- Credit counselors: If you are struggling to come to an agreement with your servicer, you may want to contact a credit counselor. Counselors typically work for nonprofit organizations and can advise you on your debts, money and budget. You may also receive assistance in negotiating with creditors.

During times of worldwide uncertainty, business shutdowns and staggering unemployment rates, you should pursue every option at your disposal for mortgage relief.

What Mortgages Qualify?

Which types of loans can you use mortgage forbearance for? To qualify for forbearance, mortgages must have backing from a federal agency or be federally owned. The new federal law known as the Coronavirus Aid, Relief and Economic Security Act, abbreviate as the CARES Act, has put new protections in place for homeowners who have federally backed mortgages. These protections are:

- A right to mortgage forbearance for the homeowners who are dealing with financial hardship as a result of COVID-19

- A foreclosure moratorium

If you are unsure who backs or owns your mortgage, you can take action using the following methods.

- Contact your loan servicer: You can ask the servicer of your mortgage about who backs your loan. Your servicer may be able to provide you with the name, address and contact information of the agency that owns your mortgage loan.

- Check online: You can use a lookup tool online via Fannie Mae or Freddie Mac to determine if one of these entities is backing your mortgage.

Government-Backed Mortgages

One of the following federal agencies may back mortgages that qualify for mortgage forbearance:

- Fannie Mae or Freddie Mac

- The U.S. Department of Veterans Affairs for VA loans

- The Federal Housing Administration for FHA loans

- The U.S. Department of Agriculture for USDA Rural loans

- The U.S. Department of Housing and Urban Development, also known as HUD

Mortgages the Government Doesn’t Back

What if you don’t have a federal agency backing your mortgage? Although the CARES Act may not require private servicers to offer relief, you may still be able to successfully apply for mortgage forbearance.

In the case of a natural disaster or national uncertainty, private mortgage servicers may adopt similar policies to those of federally backed loans. If a federal agency doesn’t back your loan, you can contact your servicer to ask what home loan relief programs they have available.

Similarly to a federally backed loan, if you and your servicer agree to mortgage forbearance or a loan modification, your bank will probably not report your paused or reduced payments to the credit bureaus.

Requesting Mortgage Forbearance or Relief

Under the CARES Act, you may have two relief options for a federally backed mortgage. Beginning March 18, 2020, the law has prohibited your servicer from foreclosing on your home for 60 days. If you are experiencing financial hardship as a result of COVID-19, you have the right to put in a request for mortgage forbearance for up to 180 days.

Beyond the scheduled amounts, you will not need to worry about penalties or additional interest or fees. The CARES Act also does not require you to submit additional documentation to your servicer to qualify for mortgage forbearance, other than your claim of financial hardship related to the pandemic.

You may also have other mortgage relief options from your state. Several states are considering or are implementing various options for home loan relief, so check your state’s website for further details.

What should you do after you have received mortgage forbearance or another mortgage relief option? Consider doing the following to further protect yourself.

- Monitor your mortgage statement: Monitor your mortgage statements every month to determine whether there are any errors.

- Store your written documentation: In case any errors arise on your mortgage statements, you may want to keep the written documentation available.

- Pay attention to your credit: You may also want to pay attention to your credit score to ensure that are no inaccuracies or errors.

- Contact your servicer once your income returns to normal: When your mortgage is in forbearance, you will need to pay your missed payments. However, with fewer missed payments, you will owe less later, so you should let your servicer know as soon as your income levels get back to normal.

If you can save money now, you may want to consider putting it away for later, when your payments are due.

Learn More About Mortgage Forbearance From Assurance Financial

At Assurance Financial, we can assist you with all of your mortgage needs. We use the technology that can help you get the mortgage loan you need as soon as possible, and we will provide you with end-to-end support so you can go through the entire process of applying for a mortgage loan under a single roof.

During times of global uncertainty, we still strive to provide you with stability and missed payment forgiveness. Our loan officers at Assurance Financial have a presence across the nation in 28 states and can assist you with any of your mortgage needs. To learn more about mortgage forbearance, reach out to a local loan officer or contact us at Assurance Financial.

Sources

Deciding to apply for forbearance can be a stressful decision. Take this quick quiz to see if you really understand how forbearnce works.

For the majority of home buyers, getting a mortgage is part of the process of purchasing a new home. In 2018, 86% of buyers took out a mortgage to buy their home. If you’re considering becoming a homeowner, you might wonder if it’s difficult to get a mortgage now or if it is the best time to shop for a mortgage loan. The truth is that the right time to apply for a mortgage will be different for every buyer. Your credit history, how much you have saved up and your income and employment history are just a few things that can determine whether you’ll qualify for a home loan and what type of interest rate and terms you’ll be offered. Some factors, such as market rates and time of year, also play a role when it comes to the best time to get a mortgage, but are usually beyond your control.

If you’re considering becoming a homeowner and are wondering if the time is right, get to know the factors that affect your mortgage eligibility and what you can do to make yourself a better candidate.

When Your Credit Score Is Ready

Any type of loan brings with it some amount of risk, for you as the borrower and for lenders. One way lenders can protect themselves is by offering the best terms to people who have the highest credit scores. If a lender determines that a potential borrower’s credit history isn’t good enough, they may reject a person’s mortgage application entirely.

As a general rule, the higher your credit score, the better your chances of being approved for a mortgage. You’ll also get a lower mortgage rate if you have a very good or excellent score. When determining your eligibility, most lenders use your FICO score, which is pulled from each one of the three credit reporting agencies. FICO scores range from 300 to 850, and the closer you are to 850, the better your score. Scores above 800 are “excellent” or “exceptional” while scores between 740 and 799 are very good. Any score below 580 is considered poor. If your score is in that range, it can be challenging to get any type of loan, let alone a mortgage.

The great thing about credit scores is that they aren’t fixed in stone. Your score likely fluctuates from month to month based on your current debt situation and whether you have and use credit cards. If you’re interested in applying for a mortgage, but don’t have a very good or excellent score just yet, there are things you can do to bring that score up. If you have a lot of debt, you can focus on paying it down. If you’ve fallen behind on payments, getting current and committing to paying everything on time will help to raise your score.

It’s also worth noting that mortgage programs allow people who don’t have the best credit scores to qualify for a home loan. Loans backed by the Federal Housing Administration (FHA), Department of Agriculture (USDA) and the Department of Veterans Affairs (VA) are examples of government mortgage programs available to people who might have credit scores in the 500 or 600 range. The mortgage programs do have certain restrictions and might require you to pay for private mortgage insurance, but they can be a good choice if you’re ready to buy a house and your credit score isn’t where you’d like it to be.

When You Have a Stable Income

Although it’s impossible to say what’s going to happen in the future with any certainty, lenders typically want to see proof that you have had steady employment and a stable income. To do that, they will look at several years’ worth of your tax returns. Ideally, your tax returns will show a constant or steadily increasing income over the years. Along with checking your income, lenders will also usually review your employment history. They often want to see that you’ve been with the same employer for at least two years. If you are self-employed, lenders will want to see at least two years of self-employment income.

Having a history of stable income not only influences whether or not you’ll qualify for a mortgage. It also influences how much house you can afford to purchase. Typically, a lender will want your total mortgage payment — including taxes, homeowners insurance and private mortgage insurance — to be between 25 and 28% of your gross monthly income. If you earn $6,000 per month, a mortgage payment between $1,500 and $1,680 should be comfortable for you.

Another way to calculate how much house you can comfortably afford is to multiply your annual income by two or three. If you earn $6,000 per month, your annual income is $72,000. That means a house between $144,000 and $216,000 is within your affordable range.

If you’re recently started working at a new job or are just getting started in your career, you might find that you need to wait a few years before you apply for a mortgage, to give your income and employment time to stabilize.

When You’ve Saved Enough

How much money do you need to have set aside before you can apply for a mortgage? Conventional wisdom says that you should have at least enough to put 20% of the price of the house down. If you’re purchasing a $200,000 home, you’d need to have $40,000 to put down. If you have that amount or 20% of the price of the home saved up, great. But not having that much money available doesn’t necessarily mean you won’t be able to buy a house or get a home loan.

Some programs, like VA and USDA loans, don’t require a down payment. Others, such as FHA loans, let you put down as little as 3.5%. You can also take out a conventional, or non-government-backed mortgage with as little as 3% down.

Although you can buy a house and get a mortgage with a small down payment, you should answer some questions to determine if it’s the right choice for you. The smaller your down payment, the larger your monthly mortgage payment. Can you afford the bigger monthly payment? If you put down less than 20%, you’ll also be responsible for paying private mortgage insurance premiums. How long you need to pay the premiums depends on the type of loan you get. The amount of the premiums depends on the size of your down payment. Your premiums will be lower if you put down 10% compared to putting down 3 or 5%. Will you be able to afford the cost of the premiums?

In addition to the down payment, you’ll need to have enough cash to cover closing costs and to create a cushion in case anything in the home needs repair or replacement after you’ve purchased it. Often, it’s recommended to have between 1 and 3% of your home’s value set aside in cash to cover the cost of repairs and maintenance. The age and condition of your home also influence how much you should save up before purchasing it. You might want to have a larger reserve for an older home with fewer updates. If the home is newer or was more recently updated, you can often safely have a smaller home repair emergency fund.

Additional Factors to Consider Before Shopping for a Mortgage

While your credit score, income and savings are three of the biggest things that determine whether or not it’s the best time to close on a mortgage, a few other factors also come into play. One of those factors is the amount of other debt you currently have. For the most part, if you want to get a qualified mortgage, your total debt-to-income ratio needs to be less than 43%. Your debt-to-income ratio is a comparison of the amount you earn each month to what you pay towards loans and debts.