For many homebuyers, the process of purchasing a home and securing a mortgage can seem overwhelming, especially if you’re learning mortgage lingo for the first time — conforming loans, non-conforming loans, conventional loans, jumbo loans, fixed rates, adjustable rates and more. With so many options, how do you decide which is the right mortgage loan for you?

For many, the decision first begins with choosing between a conforming loan and a non-conforming loan, also known as a jumbo loan. To help you determine which might be the right loan for you, we’ve compiled a comprehensive guide of the similarities and differences between a jumbo loan and a conforming loan.

What Is a Jumbo Loan?

When your ideal home is more expensive than most, you may want to opt for a jumbo loan. Jumbo loans are large mortgages secured to finance luxury homes or homes located in competitive markets.

1. How Does a Jumbo Loan Work?

A jumbo loan can be financed for a single-family home that exceeds the Federal Housing Finance Agency’s maximum loan limit. A jumbo mortgage is not backed by Fannie Mae, Freddie Mac or any government agency.

The limit on conforming loans throughout most of the country is $484,350, though this limit does vary by location and can be much higher in competitive housing markets. In competitive markets like San Francisco and Los Angeles, you can secure a mortgage for over $700,000 without the loan being considered jumbo. States like Hawaii and Alaska also offer much higher loan limits than the rest of the U.S. If you want a loan that exceeds this limit, you may want to secure a jumbo loan.

The limit also varies by the number of units on the property.

- Above $484,350 for a one-unit property

- Above $620,200 for a two-unit property

- Above $749,650 for a three-unit property

- Above $931,600 for a four-unit property

You can use your jumbo mortgage to cover your primary residence, a second home, a vacation home or an investment property. If a large, expensive home calls to you and is within your price range, then a jumbo loan may be your best financing option.

2. What Are the Benefits of a Jumbo Loan?

Aside from being able to finance the home of your dreams, why should you get a jumbo loan?

- Competitive interest rates: Though jumbo loans have historically come with higher interest rates, lenders have realized that borrowers of jumbo loans can be lower-risk and now offer interest rates that are competitive with those on conforming mortgages.

- Fixed or variable rates: With a jumbo loan, you can decide whether you want a fixed interest rate or a variable interest rate.

- No PMI payments: If you make a small down payment on a conforming loan, you will typically be required to make private mortgage insurance (PMI) payments. However, with a jumbo loan, you may be able to put down less than 20% without being required to pay PMI.

If you want to purchase a pricey home, a jumbo loan may be exactly the right mortgage option for you.

3. How Do You Qualify For a Jumbo Loan?

Jumbo mortgages tend to be riskier for a lender than conforming mortgages due to their hefty amount and their lack of backing, so qualifying for a jumbo loan can be more challenging than qualifying for other loan types.

Jumbo loan requirements include:

- An excellent credit score: Your credit score should be at least 700 to qualify for a jumbo loan.

- A low debt-to-income ratio: This ratio should below approximately 36%. You can calculate your ratio by dividing your monthly debt payments by your monthly income.

- A cash reserve: You may want to have about six to 12 months worth of monthly payments saved up to prove you have the resources to pay back your jumbo loan.

- A high, stable income: You’ll want to gather 30 days of recent pay stubs and bank statements as well as W2 forms and tax returns from the past two years. A consistent, high income will give a lender more confidence in your ability to pay back your loan.

- A large down payment: Many lenders will require a down payment of 20%, though it may be possible to put down only 10%. If you want to put down a small down payment, your credit, income and cash reserves will likely need to be even higher.

Lenders tend to be selective with the borrowers they approve for jumbo loans, so if you want to make sure you qualify, you may want to focus on building up your credit and assets.

4. Who Should Get a Jumbo Loan?

A jumbo mortgage is not designed for someone to buy more home than they can reasonably afford. Jumbo mortgages are for those homebuyers who are financially secure and want to purchase a home that is more expensive than the average property. You can look up the limits on conforming loans in your area to determine whether your dream home exceeds the limit, and if it does, you may want to look into applying for a jumbo mortgage.

Jumbo mortgages can be great for young professionals starting off in their careers who are earning a high salary, but who maybe don’t have significant resources built up just yet. If you’re a high-income earner making $250,000 to $500,000 a year, and you’re looking to buy an expensive home, a jumbo loan could be a great option for you.

What Is a Conforming Loan?

Conforming loans get their name because they conform to the parameters set by Freddie Mac and Fannie Mae. Loan terms tend to be reasonable, pricing and eligibility for conforming loans are standardized, and interest rates can be lower than non-conforming loans. A conforming loan is also called a conventional loan and is the most common type of mortgage.

1. How Does a Conforming Loan Work?

Because conforming loans follow Fannie Mae and Freddie Mac guidelines, they are widely accepted by lenders and mortgage issuers. Loans that conform to standards are easier to sell and buy.

What all conforming loans have in common are their requirements for a down payment, credit score, loan limit and debt-to-income ratio. Conforming loans are not backed by government agencies, so FHA loans, USDA loans and VA loans are not considered conforming loans, as they are all backed by the government.

Conforming mortgages come with loan limits. For one-unit properties, the 2019 limit is $484,350 in most of the country, except in counties with competitive housing markets, and therefore, higher home prices. Regardless, there is still a cap for competitive markets, which is 150% greater than the base limit. Currently, this absolute maximum is $726,525.

The amount of interest you’ll pay on your conforming loan depends on the interest rate you acquire and the length of your loan term. For example, you might choose between a 30-year or 15-year mortgage. For a 30-year mortgage, you’ll pay more interest, but your monthly payments will also be lower than with a 15-year mortgage.

If you cannot put at least 20% down, you’ll likely have to pay private mortgage insurance premiums. PMI protects the lender if you cannot make your mortgage payments, but this insurance does not protect you, the borrower.

2. Can You Refinance a Jumbo Loan Into a Conforming Loan?

If you’ve secured a jumbo loan, you may be wondering if you can refinance your loan into a conforming mortgage. Though it is possible, refinancing can be a challenge. Depending on your circumstances, it may be worth the effort if it means big savings by reducing your monthly payments and your interest rate.

To refinance your jumbo loan, you’ll need:

- A FICO score of at least 660

- A debt-to-income ratio lower than 43%

- A loan-to-value ratio of less than 80%

- A reserve of cash and additional liquid reserves

- No history of bankruptcy in the last seven years

- W2 forms and tax returns from the past two years

- Bank statements from the past 60 days

- Pay stubs from the past 30 days

If you’re looking to refinance, make sure you have all of your documents and meet the qualification requirements.

3. What Are the Benefits of a Conforming Loan?

Conforming loans offer benefits for both buyers and lenders. Because they are standardized in their rules, limits and structure, they can provide security and protection for borrowers and ease in selling for lenders. Conforming loans also offer both fixed-rate mortgages and adjustable-rate mortgages.

- Fixed-rate mortgage: This loan has an interest rate that doesn’t change through the life of the loan. Your mortgage payment will also stay the same throughout the entire loan term.

- Adjustable-rate mortgage: This loan has an interest rate that fluctuates at predetermined points in your loan term. Your interest rate will either increase or decrease depending on market conditions.

Adjustable-rate mortgages offer several options for adjustment schedules. With a 5-2 adjustable-rate mortgage, your rate will remain the same for the first five years of your loan term. At the end of five years, your rate will adjust. After that, your rate will adjust every two years. A 5-1 schedule means your rate will adjust every year after your first adjustment.

While adjustable-rate mortgages tend to start off with lower rates than fixed-rate mortgages, interest rates can also increase with every adjustment, meaning your payments will get higher. Luckily, there is generally a maximum for which your interest rate can increase. However, adjustable-rate mortgages are still riskier and less predictable than fixed-rate mortgages.

Interest rates for conforming loans tend to be lower than those you would find for non-conforming loans.

4. How Do You Qualify for a Conforming Loan?

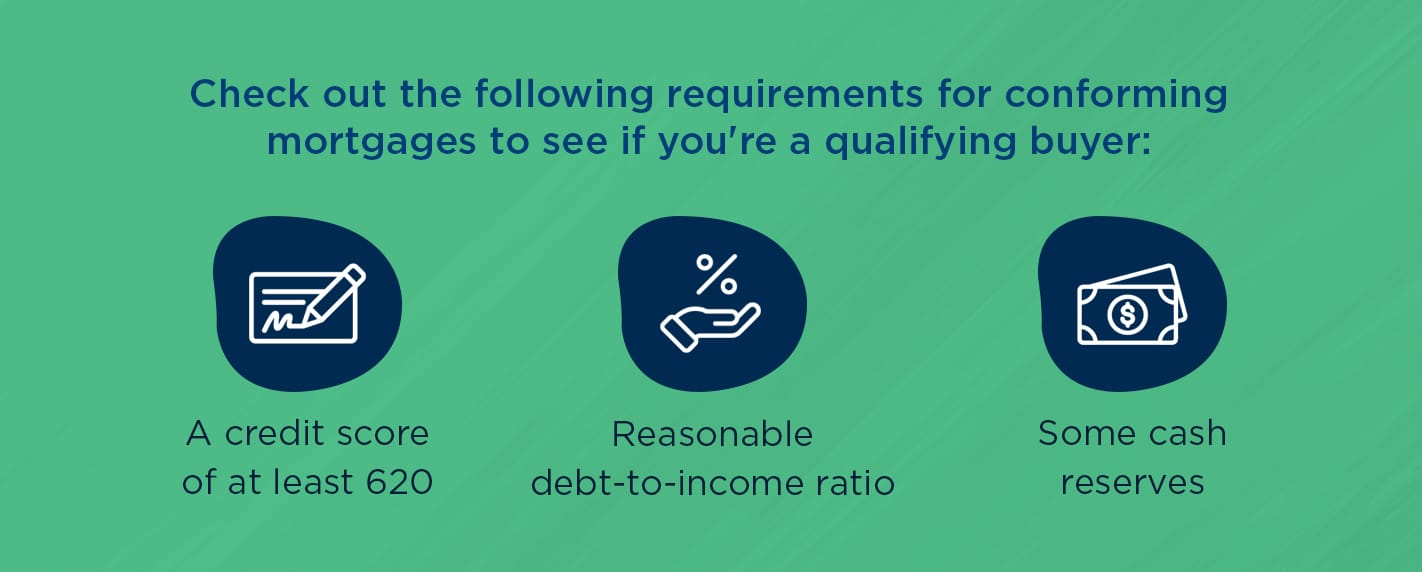

Maybe you’re interested in applying for a conforming loan. Check out the following requirements for conforming mortgages to see if you’re a qualifying buyer:

- A credit score of at least 620: Depending on the size of your down payment and the type of loan you apply for, a qualifying credit score can fall in the range of 620 to 700.

- Reasonable debt-to-income ratio: Depending on the down payment size and the loan type, your debt-to-income ratio shouldn’t be higher than 36% or 45%.

- Some cash reserves: Certain types of conforming loans may require that you have some cash stowed away to prove you are likely to pay back your loan.

Requirements vary based on the specific type of loan you apply for and the number of units in the property you’re financing, but these general requirements should give you an idea of whether you might qualify for most conforming loans.

APPLY TODAY5. Who Should Get a Conforming Loan?

For homebuyers who are looking to purchase a home within the loan limits for conforming loans and who meet the qualification requirements, a conforming mortgage can be a great option for financing your home.

Comparing Jumbo Loan vs. Conforming Loan

Jumbo loans and conforming loans both offer unique benefits to borrowers and also come with their own set of qualification requirements.

1. Jumbo Loan vs. Conforming Loan Limits

One of the biggest differences between a jumbo mortgage and a conforming mortgage is the limit for each loan. Conforming loans have a limit of $484,350 throughout most of the country, so most borrowers cannot take out a conforming mortgage for a higher amount. Jumbo loans live up to their name by offering a limit much higher than that placed on conforming loans.

While conforming loans are created for the average homebuyer, jumbo loans are designed for high-income earners looking to purchase more expensive properties.

2. Do Jumbo Loans Have Higher Rates Than Conforming Loans?

Historically, jumbo loans carried higher interest rates than conforming loans. Today, jumbo loans tend to be only slightly higher than conforming loans. However, jumbo loans can sometimes carry lower interest rates. Because the balances of these loans are higher, they carry more risk for lenders. But because high-income earners tend to have the financial ability to pay back their loan, lenders may also find them lower-risk than the average borrower, resulting in interest rates that are competitive with conforming loans.

The lower your interest rate, the less you’ll spend on interest over the life of the loan. Since mortgage loan amounts are already hundreds of thousands of dollars, the interest rate on a mortgage is one of the factors borrowers tend to consider first. If you’re unsure which loan type might be best for you, compare the interest rates you’re being offered.

3. Jumbo Loan vs. Conforming Loan Lending Standards

Jumbo mortgages tend to be more difficult for borrowers to secure because of their high limit. An excellent credit score, a significant down payment and a high, consistent income are typically all requirements to qualify for these loans.

Conforming loans are generally more accessible and offer much lower barriers for qualifying. Guidelines and standards are set by Freddie Mac and Fannie Mae, and virtually every lender offers conforming loans. For the most part, you can qualify for a conforming loan with a lower credit score, a minimal amount of savings and a small down payment.

- Jumbo loans typically require a minimum credit score of 660 or 680, while the minimum score is generally only 620 for a conforming loan.

- Jumbo loans typically require a 10% down payment or greater, while conforming loans may require only a 3% down payment.

- Jumbo loans tend to have higher interest rates, though this isn’t always true, and the difference may not be significant.

- Not all banks or lenders offer jumbo loans, so they may be more difficult to apply for and acquire.

Consider the loan terms and qualification requirements for these two loan types if you’re attempting to decide between a jumbo loan and a conforming loan.

What’s the Right Loan for You?

Ultimately, the cost of your home, your credit score, your location and your budget are what will determine what the right mortgage is for you. These six loan types offer different benefits, and some are designed with borrowers’ specific needs in mind.

- Jumbo loans: These loans are designed for borrowers who need non-conforming loans that are higher than the government-set limits.

- Conventional loans: These mortgages are conforming loans that abide by the standards and limits set by Fannie Mae and Freddie Mac. They tend to be a good option for many homebuyers and account for about two-thirds of mortgage loans issued.

- Construction loans: These loans are for borrowers constructing new homes.

- FHA loans: These loans are designed for low-income to moderate-income households and for borrowers with lower credit scores.

- VA loans: These loans are for service members and generally offer lower interest rates.

- USDA loans: These mortgages are designed for borrowers who live in a rural and sometimes suburban area designated by the U.S. Department of Agriculture.

In short, if you’re looking to purchase a home that exceeds the conforming loan limit, you may want to secure a jumbo loan. If your home does not exceed that limit, then a conforming loan may be the right mortgage loan option for you.

[download_section]

Secure Your Mortgage Loan With Assurance Financial

If you’re a high-income earner trying to decide which mortgage loan type might be the best option for you, you have a few options to consider. In the past, jumbo loans might have been thought of as risky and incredibly challenging to secure. Today, high-income earners can qualify for jumbo mortgages with terms that are competitive with conforming loans. Lenders may even see you as a lower-risk borrower than the average homebuyer because of your ability to pay back your loan.

If you have an excellent credit score, considerable assets or cash reserves to cover a down payment and closing costs, and you can secure an interest rate that’s comparable or even lower than a conforming loan, then a jumbo loan may be exactly the right mortgage loan for you. Why shouldn’t you be able to buy the home of your dreams if you can afford it?

No one else can decide what the right mortgage is for you, but we hope our comprehensive guide on the similarities and differences between a jumbo loan and a conforming loan helps you make your decision.

Ready to finance your dream home? As an independent lender, we care about our borrowers and want to help you every step of the way along your journey to homeownership. With Assurance Financial, you’ll find end-to-end processing of your mortgage all under the same roof.

Speak to an expert loan officer today so we can help you secure the right mortgage for your new home.